UK house prices have recorded a quarter-on-quarter fall for the fourth month in a row for the first time since 2012, according to the Halifax.

The mortgage lender said that property prices between May and July were 0.2% lower than the previous quarter.

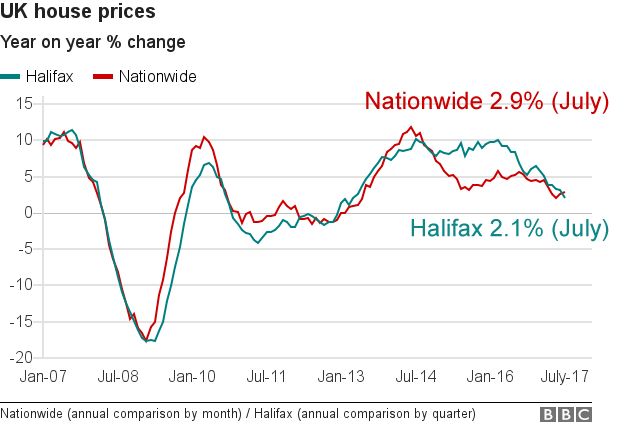

The figures, based on Halifax’s own mortgage data, showed annual house price growth had slowed to 2.1%.

A number of surveys have suggested a cooling or relatively stagnant UK housing market.

“House prices continue to remain broadly flat, as they have since the start of the year,” said Russell Galley, of the Halifax.

The Halifax said the cost of the average home rose by 0.4% between June and July, with the average property valued at £219,266.

First-time buyers will be given some cheer from the figures, which indicate that house prices are not accelerating out of reach at a pace seen previously.

A year ago, house prices were growing at an annual rate of 8.4%, but the pace has since slowed.

The Halifax says demand is weaker owing to a cocktail of weak wage growth, a rise in prices in the shops, and affordability concerns. It echoes its rival, the Nationwide, in pointing to a continuing shortage of houses on the market as a reason why prices are still rising, albeit at a slower rate, rather than having fallen.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “Mortgage rates are staying extremely low. This state of affairs has been supporting the housing market to an extent and is likely to continue to do so with no immediate interest rate rise on the horizon.

“One of the big issues facing prospective buyers is not so much getting the mortgage they need but finding a property they wish to buy. Until supply improves, this will continue to be the case.”