Three major lenders have announced they will raise rates on new fixed deal mortgages on Tuesday (30th April).

Nationwide, Santander and NatWest will push up the cost of new deals as uncertainty remains over lending costs.

They follow various rivals who lifted their rates last week.

Expectations of the extent and speed of interest rate cuts by the Bank of England have been scaled back, prompting the changes.

Multiple moves

The interest rate on a fixed mortgage does not change until the deal expires, usually after two or five years, and a new one is chosen to replace it. Doing nothing would leave people on a variable rate, which is very expensive.

About 1.6 million existing borrowers have relatively cheap fixed-rate deals expiring this year, so need to make their minds up.

Many may have expected rates on new deals to fall consistently this year, following previous upheaval.

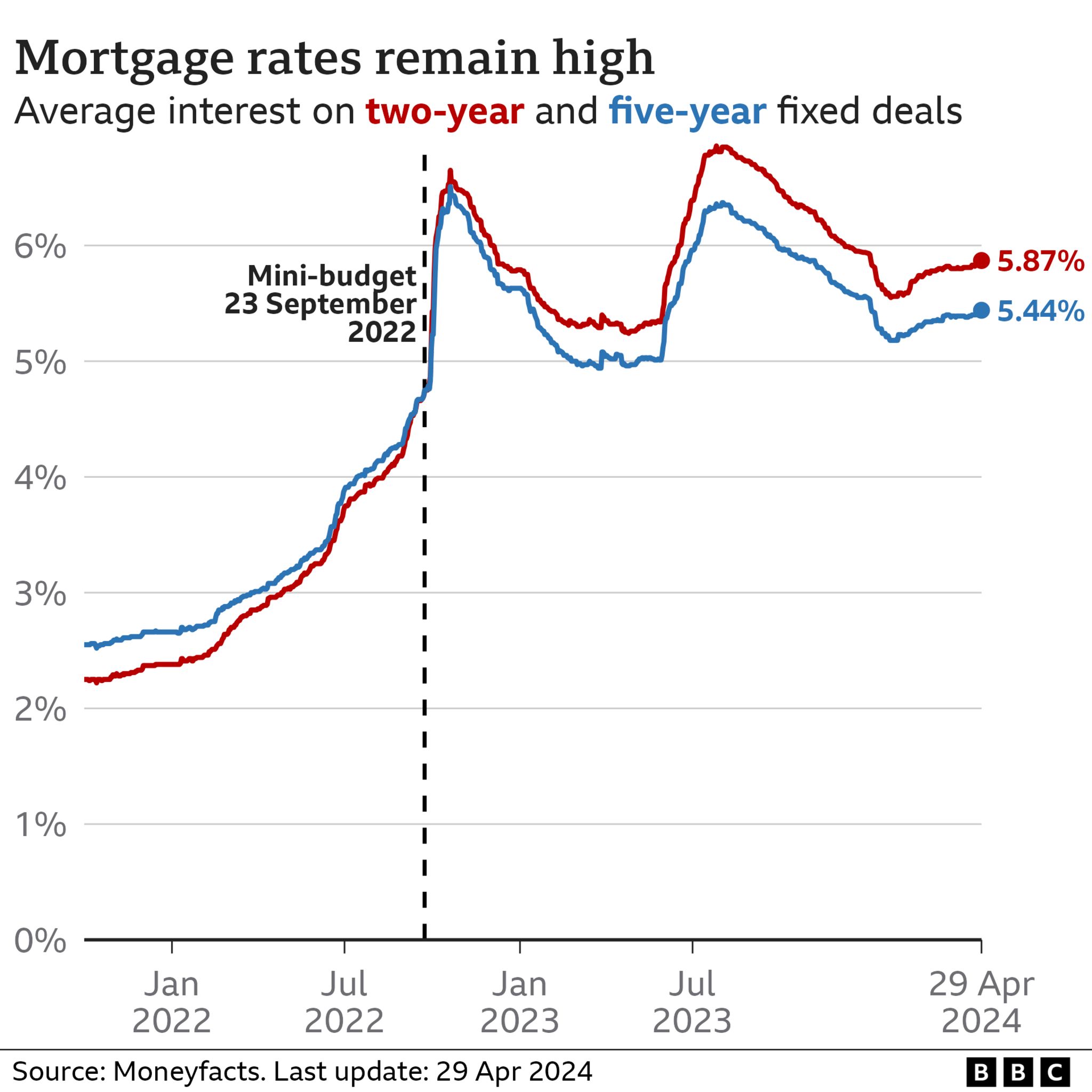

Although the year started with some sharp drops, this subsequently stabilised and recently rates have been inching back up again.

For example, Nationwide – the UK’s biggest building society – will increase rates on deals by up to 0.25 percentage points on Tuesday.

The average rate on a two-year fixed deal is now 5.87%, according to the financial information service Moneyfacts. That is still about a percentage point lower than last year’s peak.

Mortgage brokers say the moves of recent days are not another cycle of rapidly rising mortgage rates, the likes of which were seen in the last two years.

However, some borrowers had banked on rates going down, so this could influence the decisions about whether and when to move home.

“This is not one-way traffic and could change again soon,” said David Hollingworth of L&C Mortgages.

Aaron Strutt from Trinity Financial said: “Many people expected the cost of fixed rates to drop rather than increase and these higher rates do put people off buying.

“It would not be a surprise to see more banks and building societies raising rates this week.”

The Bank of England makes its next decision on benchmark interest rates on 9 May.

It is now not expected to cut the rate as early or as often as previously thought.