Tenants typically spend more than a quarter of their monthly salary before tax on rent, official figures show, but there are wide regional variations.

They paid an average of 27% of their gross salary to their landlord in England in 2016, the Office for National Statistics (ONS) data shows.

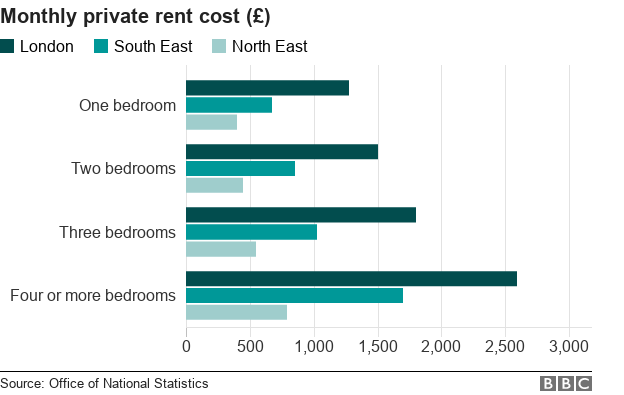

The picture varies across the country. In London, tenants spent nearly half (49%) of their salary on rent.

In northern England, this falls to just under a quarter of salary (23%).

Given the proportion of salary being spent on rent, a campaign is aiming to ensure regular rent payments are included in tenants’ credit records.

Tenants in the South East of England, East of England and the South West all paid more of their salary on rent than the average across England.

In areas of Wales, the proportion of salary spent on rent ranged from 18% to 29%, according to the ONS data, which does not cover Scotland and Northern Ireland.

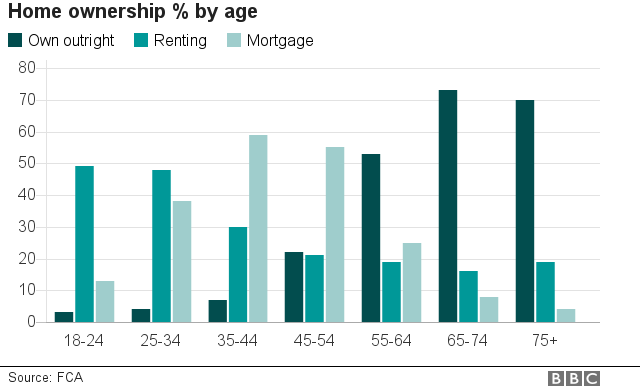

Tenants are more likely to be young and at a greater threat of getting into debt that they struggle to repay than many homeowners.

While the cost of servicing a mortgage has fallen since the financial crisis, the cost of renting in some parts of the country has risen sharply.

A campaign is being conducted aiming at ensuring credit rating agencies take regular rent payments into account on an individual’s credit profile, given that such a large proportion of salary is being spent on rent.

This is being led in the House of Lords by Lord Bird, the founder of the Big Issue magazine, which is sold on the streets by homeless people.

He said it was unfair that mortgage applicants were unable to rely on rent payment history as proof that they would be safe to lend to when buying a home.

Speaking to the BBC, he said that the situation was another example of how many people on lower incomes faced higher costs than the better off.

He said that there was a chance that those with a chequered payment history could be excluded from products or even a place to live, and solutions needed to be found for that problem.

There was also no clear-cut examples across the world of such a system of rent being considered by credit reference agencies working well.

The government has argued that new technology should allow rental payment history to eventually be used as evidence to lenders of a good record of repayments.

However, Lord Bird said: “Many people in the rented sector may not have the skills or the digital profile to do this. Something needs to be done for the mass of people.”

He told the BBC that it was a “terrible situation” that so much of the UK’s wealth was tied up in property, rather than businesses.