Move into your dream home and the dog immediately chews the new sofa.

The result: more stress which, according to an expert, was probably the cause of the furniture destruction in the first place.

“Dogs will pick up on your stress when moving house,” says Gwen Bailey, founder of Puppy School, a network of canine training classes.

“It is best to leave them with relatives for a couple of weeks so they can move into a more settled house.”

One in four UK households own a dog. More than a million homes are expected to be bought next year. That is a lot of hounds on the move.

So, given that 2018 is the Chinese Year of the Dog (beginning in February), perhaps the UK’s favourite pet should get a little more consideration during the upheaval of moving home.

At least property-buying dog lovers will have something to help them in 2018 – time to prepare.

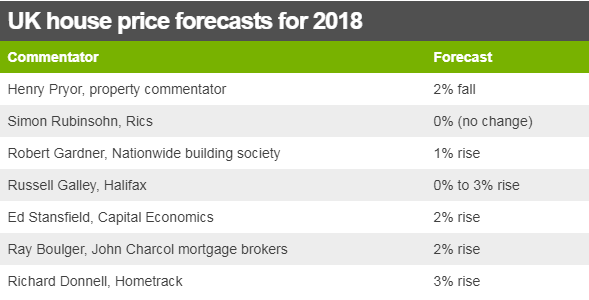

The ongoing income squeeze means experts do not expect a surge in demand among potential buyers next year. Prices will only creep up.

So, nobody need buy and move in a rush.

Ms Bailey, whose book The Perfect Puppy has been in print for 21 years, says that dogs can become more territorial, aggressive, keen to chew anything, or docile – depending on their personality – during the stress of moving home.

She suggests that making up the dog’s bed, making sure they have their water bowl, and establishing a routine, should be priorities, however untidy the new home.

The new home offers everyone the chance of a fresh start, even the dog, she says, while her seven-month-old Vizsla, Otto, plays around her.

“This is a perfect opportunity to start again, to introduce some new rules and new routines. So if, say, you do not want your dog to go upstairs, then a new home is a good time to make that change,” she says.

She also suggests that dog owners consider their new neighbours when moving home, particularly if there are cats or children next door.

But what are the chances of many people getting new neighbours in 2018?

Simon Rubinsohn, chief economist at the Royal Institution of Chartered Surveyors (RICS), says the housing market in many areas will be muted owing to a constraint on affordability.

The RICS prediction, drawn from surveyors across the UK, has one of the best track records for accuracy. In 2018, the expectation is for house prices to be unchanged, and for the cost of renting to rise by 1%.

However, this masks a big regional difference. Prices might well fall in London and the South East of England, RICS predicts, while rising fastest in Northern Ireland, Scotland, Wales and the North West of England. House prices compared to earnings are still lower than before the financial crisis in these areas where property values are expected to increase.

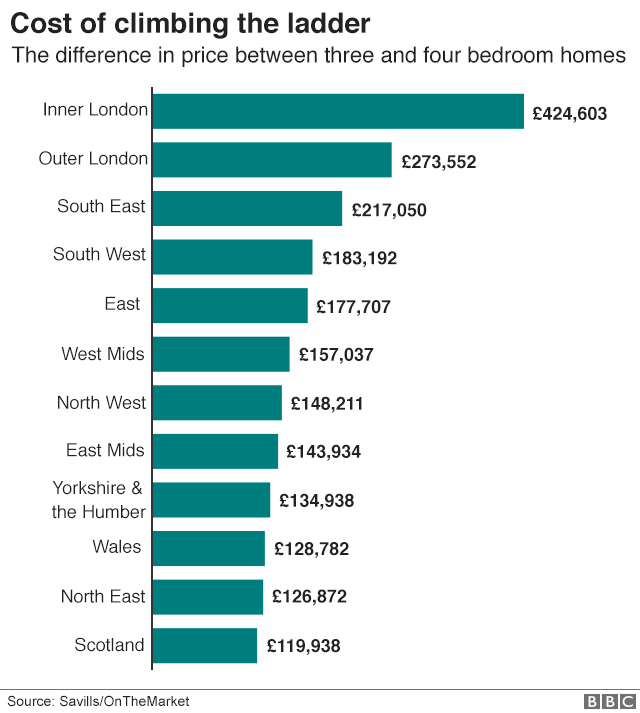

It is not only geography that housing market analysts believe will be important in 2018, but also the type of property.

Property portal Rightmove, which tracks asking prices, expects homes with two bedrooms or fewer to rise in price by 3%, compared with a 2% rise in three- and four-bedroom homes.

But the jump in price remains the greatest when moving from a three- to a four-bedroom home, rather than moving between smaller homes.

Housing commentator Henry Pryor, whose previous prediction of a 4% fall in house prices in 2017 is looking well wide of the mark, says house price predictions are a folly. The effect of interest rates, government schemes to assist first-time buyers, and the sentiment of lenders, can have a big effect on prices and are difficult to foresee.

In 2018, the B word (Brexit) might make buyers delay any potential purchase, he says, but the D words (debt, divorce, and death) will continue to drive some activity in the housing market. Again, he expects house prices to fall in 2018.

Ed Stansfield, chief property economist at Capital Economics, who is predicting a 2% rise, agrees that buyers and lenders will be cautious in 2018. This, he says, will be the effect of interest rates. The Bank of England recently raised its benchmark rate for the first time for 10 years. It now stands at 0.5%

For Ray Boulger of John Charcol mortgage brokers the impact of any further rises in interest rates would not create too much of a struggle for those who have taken out a home loan recently. These homeowners would already have been tested to ensure they could cope with larger interest rate rises, and most are on fixed-rate deals.

Where it could have an effect, he suggests, is by reducing the maximum mortgage available to new applicants.

First-time buyers need to find an average deposit of about £33,000, according to Russell Galley, of mortgage lender Halifax. At least this group will be cheered by predictions of small rises, or even falls in house prices.

This leads to what, for many people, is the deciding factor on whether to buy their first home, move to a bigger one, or stay put.

It is not potential interest rate rises, not the accessibility of mortgages, and certainly not the welfare of the family pet. It is how well off people feel.

So, experts agree, a predicted ongoing squeeze on incomes will probably mean a somewhat static UK housing market in 2018.

That might be good news for Fido at least.