Potential first-time buyers must typically save for eight years to afford a deposit to buy a home, data suggests.

A typical 20% deposit in London is now more than £80,000, according to the Nationwide Building Society.

Elsewhere in the UK, the average deposit could be closer to £20,000, the lender said.

The squeeze on wages and low interest rates makes it more difficult to raise the money than a decade ago.

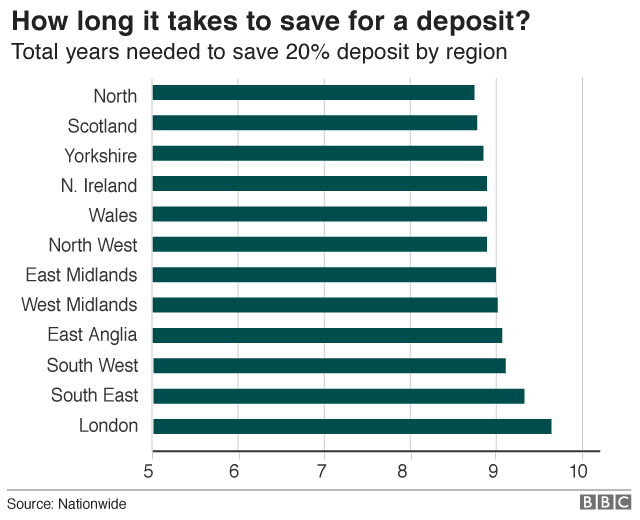

The Nationwide, which calculated that house prices rose by 2.6% in 2017, analysed its mortgage data for the cost of the typical first-time buyer’s house purchase in each region, based on four times a buyer’s income, and from this derived how much a 20% deposit would be.

The £80,000-plus cost in London is about £30,000 higher than a decade ago.

In other regions, such as the Midlands and northern England, deposit requirements are similar to 2007, when prices were at their pre-crisis peak. However, real earnings have generally fallen for young people since then and savings rates are low.

The Nationwide then calculated the length of time it would take for buyers in each region to save such a deposit, based on squirreling away 15% of their take-home pay.

In most regions, it would take about eight years for the typical buyer to save for a deposit. This rises to nine years in the South East of England and to nearly 10 years in London.

Lenders have been told by regulators to set stricter affordability requirements since the financial crisis, to avoid financial stress on the system and on individual borrowers.

This created noticeable extra pressure on the need for first-time buyers to save compared with before the financial crisis. Many have turned to parents and other relatives to help with the cost.

Iona Bain, founder of the Young Money Blog, said this could be dangerous for young borrowers.

“The Bank of Mum and Dad, or Granny and Grandad, can come with big legal pitfalls, particularly if you’re borrowing money with a partner, while trying to grow your money in more exotic ways through crowdfunding or Bitcoin, for instance, could put your whole deposit at risk,” she said.

“The only other alternative is to simply save harder for longer. That means putting all your spare change into a home where you’ll have to live for many years to come, since you’ll struggle to move up the housing ladder.

“That doesn’t sound very attractive if you’re not sure about your future and you’re trying to keep all your options open.”

Dan Wilson Craw, of the Generation Rent lobby group, said: “High housing costs are eating into renters’ take-home pay which makes saving for a deposit difficult in the country as a whole but near impossible in London and the South East of England.

“Renters deserve a stable home in return for their rent, but private tenancies simply do not offer this.”

Meanwhile, demand for mortgages remains relatively static, so lenders are still getting the custom.

Bank of England figures show that 65,139 mortgages were approved for house purchases, for new and existing owners, during November. This is very close to the average of the previous six months. The total value of these loans was £11.9bn.

The figures come the day after the government claimed more than 16,000 first-time buyers have saved thousands of pounds as a result of changes to stamp duty.

The Autumn Budget abolished stamp duty for first-time buyers of homes up to £300,000. For properties costing up to £500,000, no stamp duty will be paid on the first £300,000.

According to the government, the changes mean savings of up to £5,000 for first-time buyers. Labour said cutting stamp duty just drove up house prices