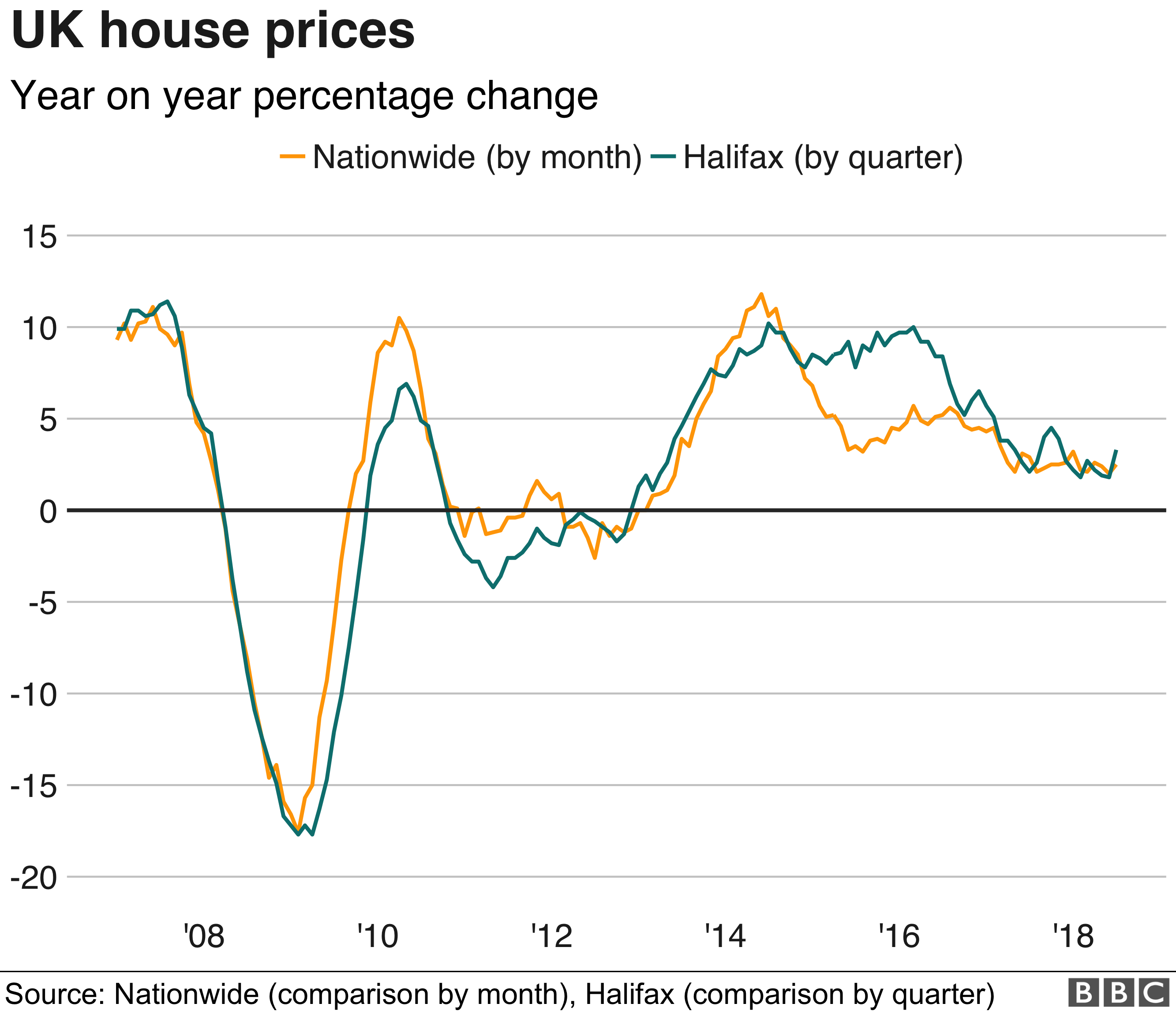

UK house prices picked up last month, rising at the fastest annual pace since November, the Halifax has said.

The lender says prices in the three months to July rose by 3.3% from a year earlier, with the average cost of a house hitting a record £230,280.

Prices in July rose a stronger-than-expected 1.4% from the month before.

Despite the rises, Halifax said housing activity remained “soft”. It also said it did not expect last week’s interest rate rise to have much impact.

The Halifax’s latest survey echoed that of rival Nationwide, which also reported a pick-up in the annual rate of price growth in July.

Nationwide said annual house price growth accelerated to 2.5% in July, with the cost of the average home rising to £217,010.

Last week, the Bank of England raised it’s key interest rate to 0.75% from 0.5%, which is set to affect the 3.5 million people with variable or tracker mortgages.

However, the Halifax said it did not anticipate that the rise would have a “significant effect on either mortgage affordability or transaction volumes”.

The lender added it did not expect much pick-up in activity for the rest of 2018.

“Despite the recent modest improvement in mortgage approvals, the latest survey data for new buyer enquiries and agreed sales suggest that approvals will remain broadly flat until the end of the year,” said Russell Galley, managing director at the Halifax.

“In contrast, the labour market remains robust, with the numbers of people in employment rising by 137,000 in the three months to May with much of the job creation driven by a rise in full-time employment.

“Pressures on household finances are also easing as growth in average earnings continues to rise at a faster rate than consumer prices.”

Howard Archer, chief economic adviser to the EY Item Club, said that, despite the spike in prices reported by the Halifax, “we doubt that the housing market is starting to see a marked upturn”.

“The impression remains that the housing market is struggling to really step up a gear in the face of still limited consumer purchasing power, fragile confidence and expectations of the Bank of England edging up interest rates,” he said.

“We expect house price gains over 2018 will be limited to around 2.5%. At this stage, we expect prices to rise no more than 3% in 2019.”