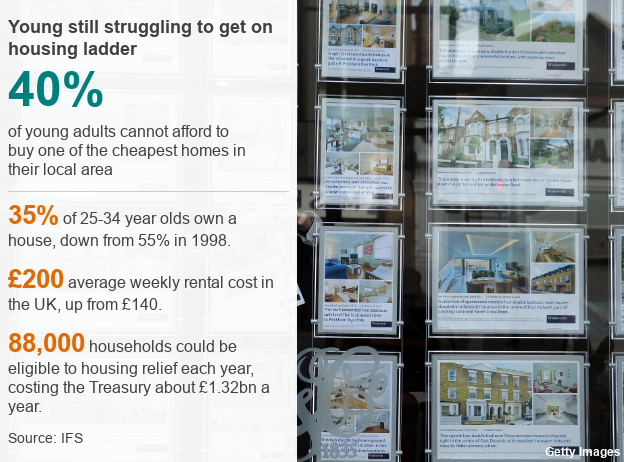

About 40% of young adults cannot afford to buy one of the cheapest homes in their area even with a 10% deposit, according to a new research.

The Institute for Fiscal Studies said house prices in England have risen by 173% over two decades.

But average pay for 25-34 year-olds has grown by just 19% over the same period.

In 1996, 93% of those with a deposit who borrowed four and a half times their salary could purchase a home but that fell to 61% in 2016.

The IFS also said that higher rental costs – up from an average £140 a week to £200 a week in England – have “reduced the purchasing power of young adults’ incomes” and made it harder to save for a deposit.

‘Impossible challenge’

Bradley Tucker, a 27-year-old recruitment worker from King’s Langley in Hertfordshire, is struggling to save for a deposit.

He and his partner have moved from a rented flat to a shared house, so they can start to save something.

But while his dad – a bricklayer – managed to buy a house after just one year, Bradley estimates it will take them at least a decade.

“On a current trajectory, the cheapest deposit is £15,000 to £20,000, so you’re looking at 10 years plus,” he told the BBC.

“For young people, it seems an almost impossible challenge. It’s a depressing outlook.”

Onward, a think tank, has suggested that the government should give UK private renters a chance to buy their home by rewarding landlords who sell to long-term tenants.

It says buy-to-let properties should be eligible for 100% capital gains tax relief if sold to a sitting tenant who has lived there for three years.

Onward says the average gain per property would be £15,000, or £7,500 for both the landlord and tenant, helping those tenants to apply for a mortgage.

Compare rent affordability in your area with Britain as a whole

Contains OS data © Crown copyright and database rights 2018. Scroll down for methodology. Insufficient data is available for Northern Ireland.

The Residential Landlords Association (RLA) said it welcomed the idea of lower taxation, but said landlords would prefer to get tax relief on rent from long-term tenancies, or a refund of Stamp Duty.

‘Inequality’

The centre right think tank estimates 88,000 households would be eligible to take up the relief each year, costing the Treasury around £1.32bn a year.

A spokeswoman for the Treasury declined to comment.

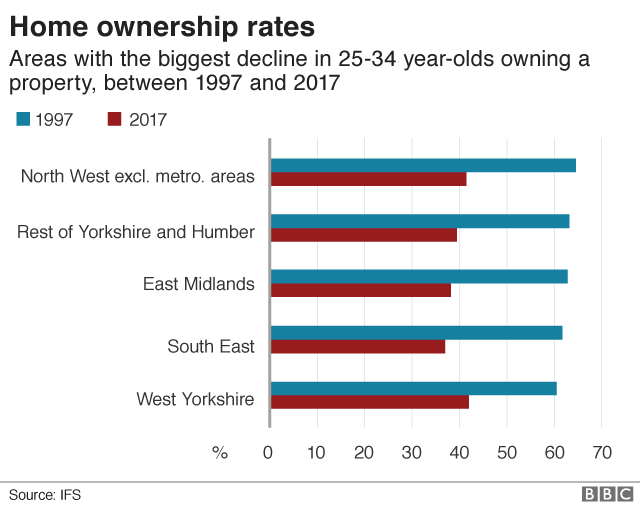

The IFS said that the proportion of 25-34 year olds who own a house has dropped from 55% two decades ago to 35%.

Meanwhile, the rate of homeownership for those aged between 65-74 years old has risen gradually to around 80%.

Polly Simpson, a research economist at IFS and a co-author of the study, said: “Many young adults cannot borrow enough to buy a cheap home in their area, let alone an average-priced one. These trends have increased inequality between older and younger generations.”

The IFS said that it is key for the government to increase the supply of homes.

It said that planning restrictions, such as within the Green Belt, prevents the construction of new homes in response to demand.

“Without increasing supply, policies to help young adults get onto the housing ladder will continue to push up house prices – and potentially rents too, which would hurt those young adults who will never be able to buy their own home,” it said.

A spokesperson for the Ministry of Housing, Communities and Local Government said that 1.1 million properties had been built since 2010.

They said: “This government is committed to helping more people get on the housing ladder and last year saw the highest number of first time buyers for over a decade.”