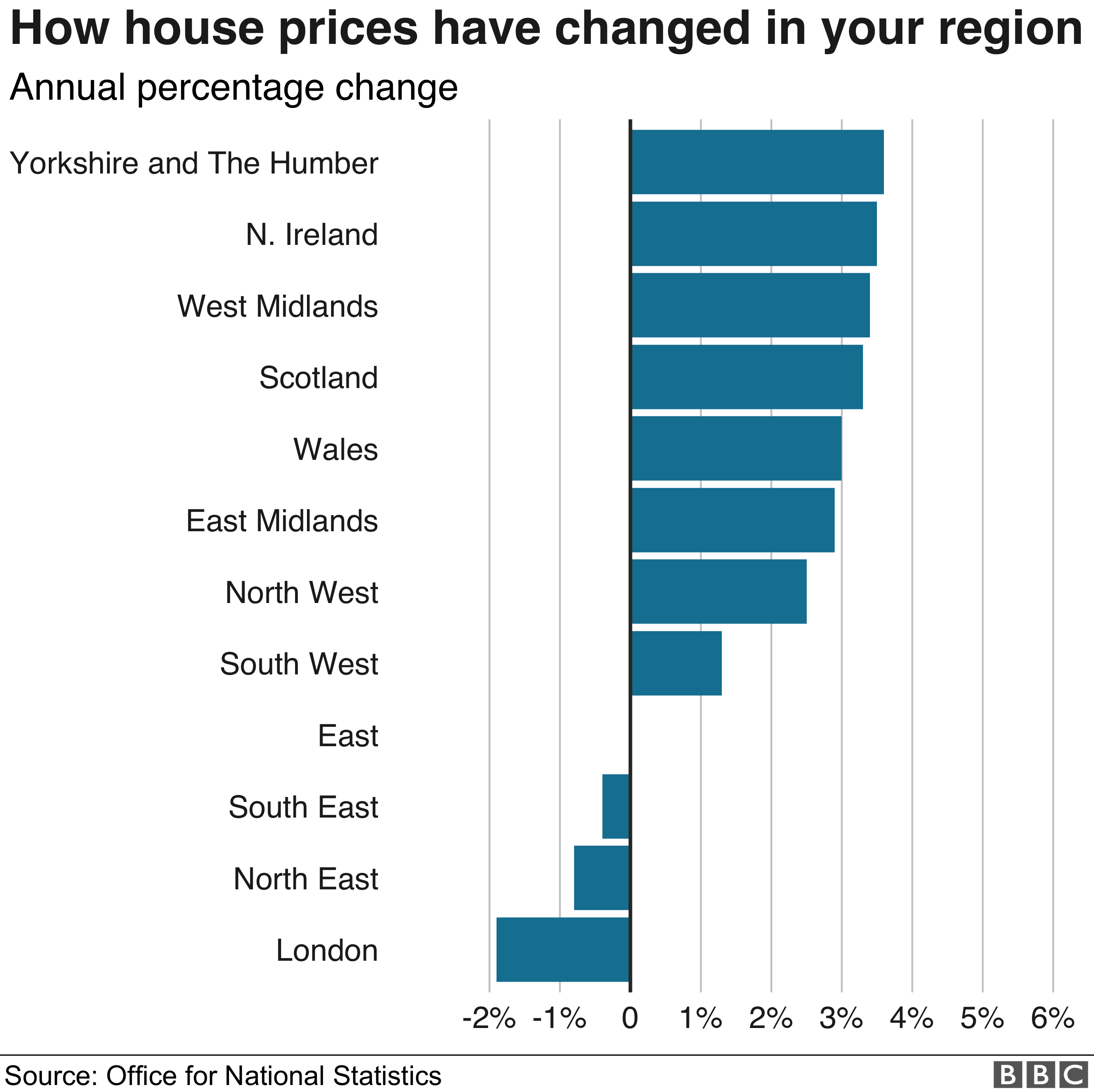

A North-South divide has opened up when comparing house prices, according to official figures.

Property values fell by 1.9% in London in the year to March, but rose by 3.6% in Yorkshire and Humberside, the Office for National Statistics (ONS) said.

House prices in Scotland recorded a 3.3% increase over the same period, the data shows.

But a home in the South East of England – and particularly London – still costs more than elsewhere in the UK.

The ONS also said that rent paid by tenants to private landlords in the UK rose by 1.2% in the year to April.

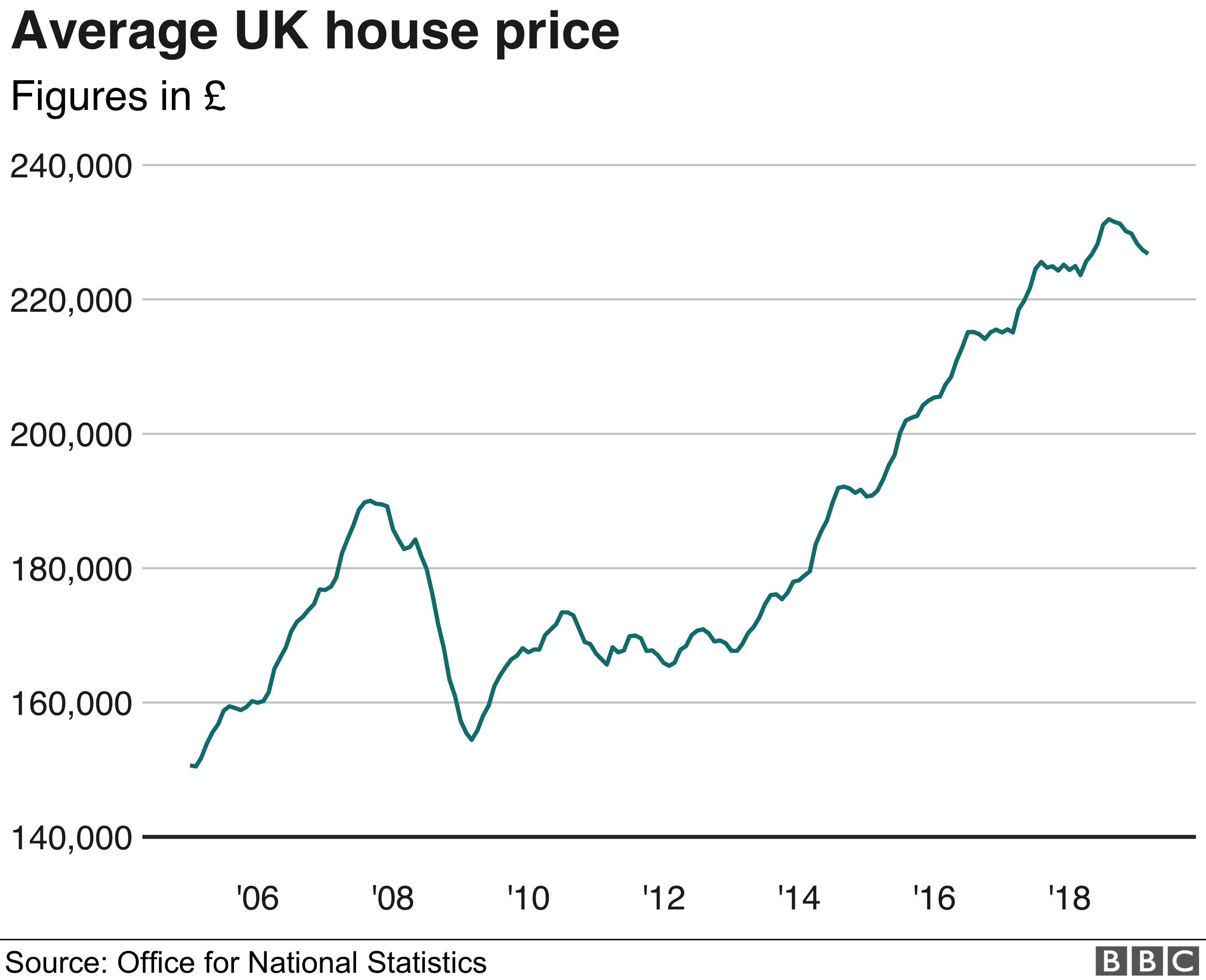

The average UK house price was £227,000 in March, up 1.4% on the same month a year earlier.

The national and regional variations in house prices reveal the differing picture for property buyers and sellers in different parts of the country.

While there is a North-South divide at the top and the bottom, there has also – for example – been a drop in prices over the last year in the North East of England.

Commentators have said that Brexit uncertainty has particularly affected London, with some putting such a major purchase on hold.

Lucy Pendleton, founder director of estate agents James Pendleton, said: “London is also not the blueprint for the whole country, as a very different story is being told everywhere else.

“A hot property market in the Midlands and North West is propping up the UK’s overall picture and this, together with declines that have so far not been dramatic in London, show property is still the relatively safe long-term investment it has always proved to be.”

Property is still rising in price, and London remains the most expensive part of the country, at an average price of £463,000.

Some areas of London with the most expensive homes have seen the biggest falls in average house prices in the last year.

Tomer Aboody, director of property lender MT Finance, said that high-end properties in the £2m to £8m bracket were 20% to 30% cheaper than in the 2015-16 peak.

“There is more value for money in property at this level and buyers may be able to afford what they couldn’t have dreamed of in the past,” he said.

“Elsewhere, growth in property prices in the Midlands and north of the country shows confidence in projects like HS2, which will one day get off the ground. The North-South divide is narrowing with increased ability to travel between the regions for work and it means that it may be possible to live in cheaper parts of the country.

“The appeal of greener pastures and a better standard of living will mean those areas will go up in value.