“When I found out that we were going to have a stamp duty holiday, I jumped for joy,” says Sally Stuart.

The Salford-based university lecturer reckons the chancellor’s announcement on Wednesday will save her and her husband about £8,000.

“We’re in the middle of buying our £346,000 dream home and have agreed a completion date of 30 July.

“it means we’ll have some money to use when we move in. The house needs some work doing to it, so we can use it there.”

Sally and husband Mike – a software developer – have both been working from home during the coronavirus crisis.

They started home hunting in February and quickly found the house they wanted.

“But then Covid happened and we were at the stage of searches which meant everything stopped. It was really frustrating,” Sally says.

It was only when the lockdown started easing, and estate agents were allowed to start showing people around again, that it started moving again.

“We’re having to think twice about how we’ll work in the future, but we’ll use some of the extra money to make a little office to work from home.

“It’s something I never would have considered before coronavirus times, but the stamp duty holiday has proved to come at just the right time for us.”

‘It should be backdated’

The timing of the stamp duty holiday – it started on Wednesday 8 July – has angered James Davies.

“We’re almost £10,000 out of pocket, because we completed a week ago,” he says.

“It should be backdated to help the ones that didn’t pull out of their house purchase.”

In March, all looked rosy for James and his wife, who lived in Preston.

“I had a nice job, my wife had recently got a new job in the tourism industry and we rescued two golden retrievers.

“We all know what happened next.”

The couple decided to continue with their purchase of their new home in East Riding of Yorkshire despite lockdown: “We just didn’t want to let the coronavirus win!” James says.

They paid the deposit on their new home last Wednesday, 1 July, and paid £9,750 in stamp duty tax.

On the same day, James was made redundant from his job in the food industry, where he was an account manager in the airline and restaurant/foodservice sector.

“Our new situation means we could really do with that money now and it would make a huge difference to us.

“We carried on paying solicitors, the mortgage broker, surveyors, van rental guys, a storage unit, spending thousands of pounds believing in our government to do right by us if there was a stamp duty holiday.

“Now we feel let down. It feels like we’ve been penalised. If they backdated it to the beginning of the month, we would qualify for the holiday.”

Mixed reaction

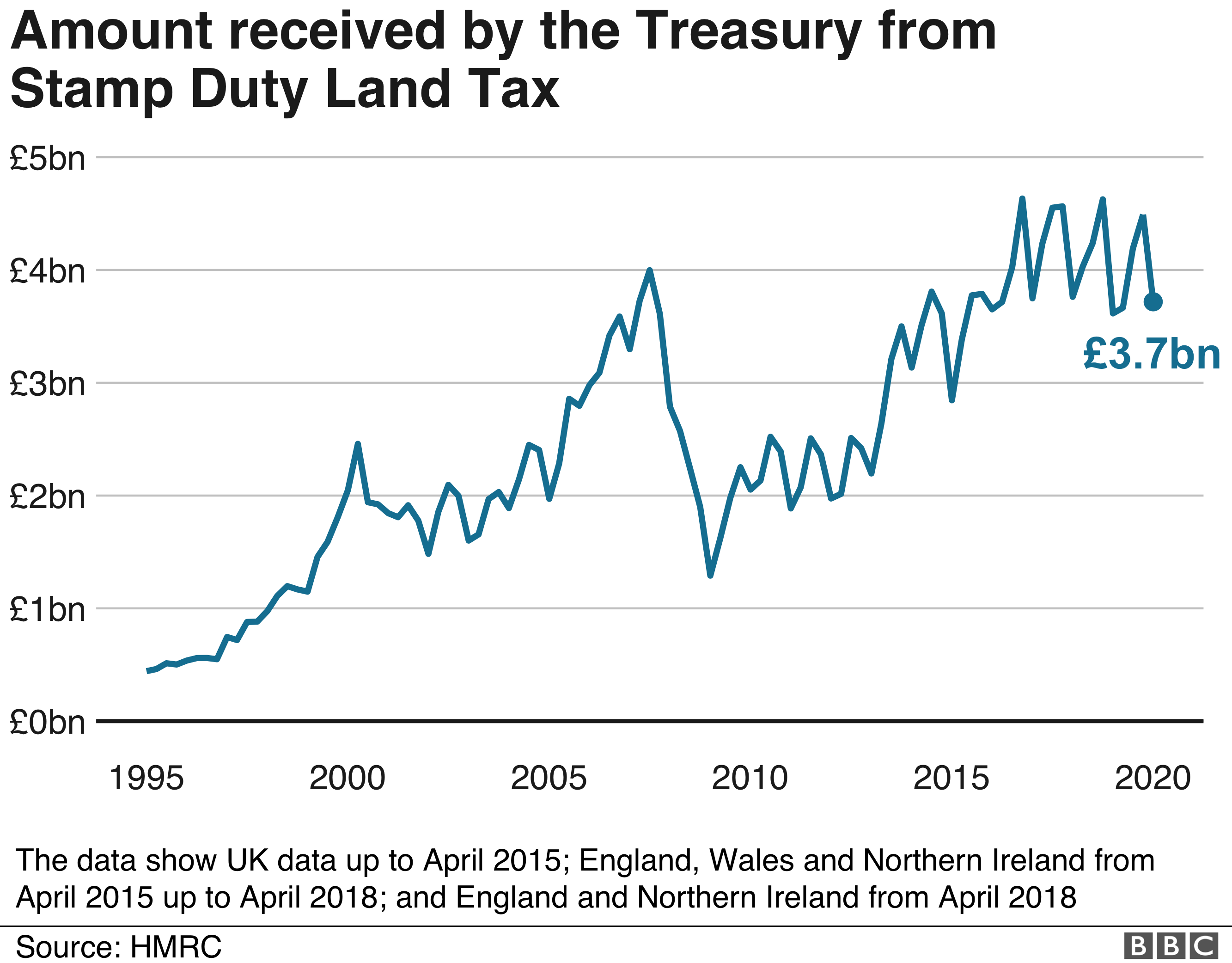

On Wednesday, Chancellor Rishi Sunak announced a temporary holiday on stamp duty on the first £500,000 of all property sales in England and Northern Ireland until next March.

He said the move would save the average house buyer £4,500.

There has been a mixed reaction to the news.

“The chancellor’s announcement should give a welcome boost to the housing market and in turn, have positive knock-on effects for the wider economy,” said Eric Leenders, managing director of personal finance at UK Finance.

“The stamp duty holiday might have a positive indirect impact on a long list of related industries, such as house builders, conveyancers, estate agents, finance and insurance providers, house movers and furniture and garden retailers,” said Jamie Ward, head of stamp taxes at PwC.

But critics said the temporary move needed to be longer.

“It gives little opportunity for house builders to use the reduction to inform strategic decisions on construction plans beyond the next nine months,” said Chris Denning, partner at MHA MacIntyre Hudson.

“Making the stamp duty cut temporary is a gamble,” warned David Westgate, group chief executive at Andrews Property Group.

“Cliff-edge deadlines completely distort the market and rarely benefit the consumer.”

He warned of “a boom scenario” between now and April next year, “when a disproportionate number of people are buying at higher prices”.

Sarah Ryan, head of conveyancing at law firm Simpson Millar, called on the government to make the scheme retrospective to help people like James Davies.

“For people who have managed to complete on the purchase of their home either during lockdown, or in the immediate aftermath, this will come as a bitter blow,” she said