The cost of the typical UK home has risen to more than £250,000 for the first time, according to the UK’s biggest mortgage lender.

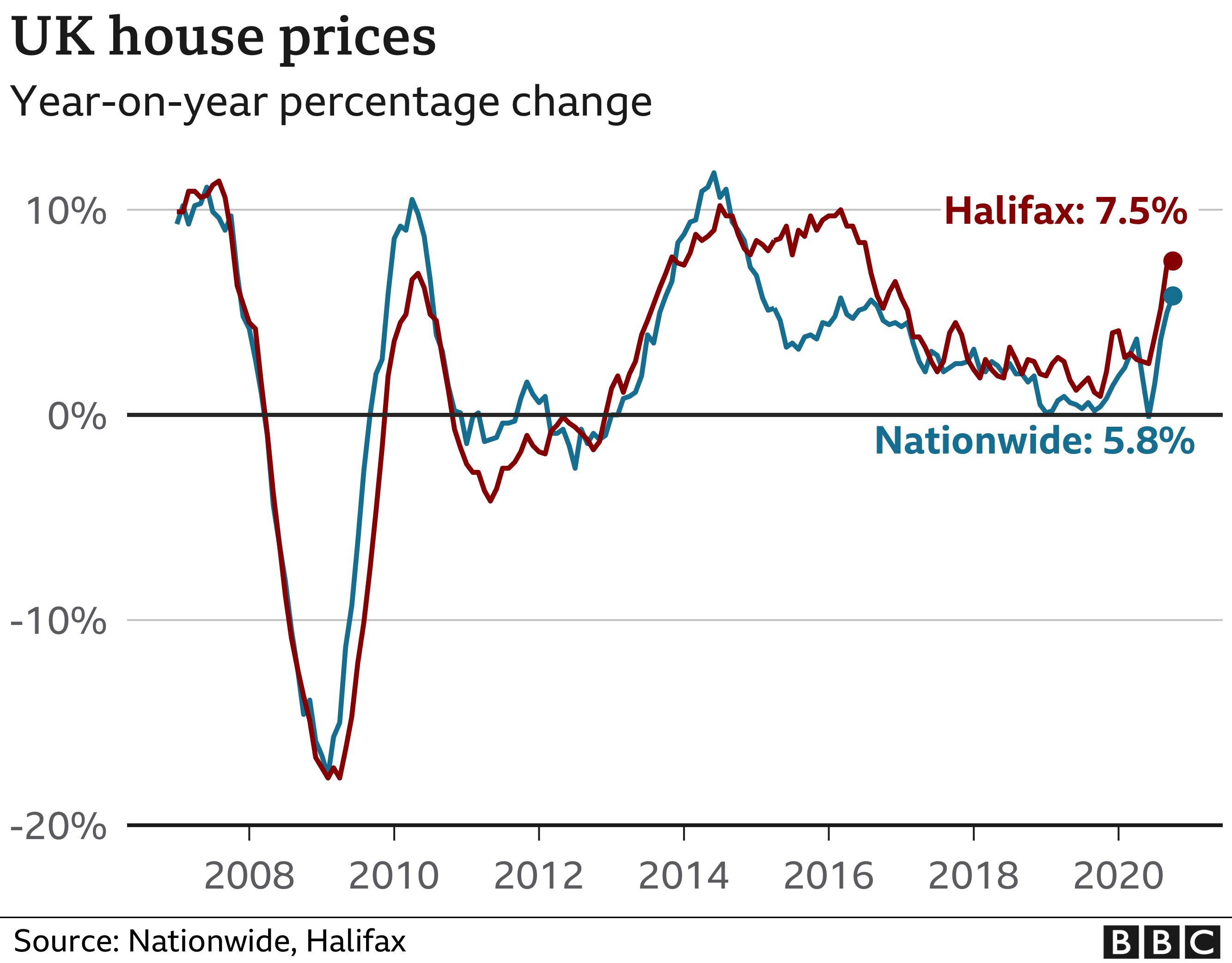

The Halifax, part of Lloyds Banking Group, said house prices in October were 7.5% higher than a year ago.

Demand for bigger homes had risen, with changing priorities and working from home leading people to seek more space.

But the lender said the economic fallout from the Covid-19 crisis would put “downward pressure” on prices.

It said this would come in early 2021, and the month-on-month increase in property values had already started to slow.

Downturn delay

Russell Galley, managing director of the Halifax, said that the extension to furlough and other government support such as the stamp duty holiday had delayed the downturn, but the future remained uncertain.

“The country’s struggle with Covid-19 is far from over,” he said, and this created “clear headwinds” for the UK housing market.

In October, prices continued to rise, continuing a 5.3% gain over the past four months, the strongest since 2006, the Halifax said.

The annual rise in prices was at its highest rate since mid-2016 and mirrored the trend reported by rival, the Nationwide. Both base their figures on their own mortgage data.

The Halifax said that the typical property in October now cost £250,547. However, the Nationwide calculated the average price at £227,286.

The Halifax said it was larger homes that had seen the biggest price rises since lockdown.

Since March, prices of flats were up by 2% compared with a 6% increase for a typical detached property. In cash terms that equated to a £2,883 increase for flats compared with a £27,371 rise for detached houses.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “People require more outdoor space and not all flats have roof terraces and balconies. But while Covid is having a massive impact it is likely to be temporary in the scheme of things, with people not able to work from home four days a week forever.

“Once we have more normality, [employers] will want to see people in the office more. Those flats that are 20 minutes from the workplace will be more appealing than a house on the Dorset coast if you have to be in the office four times a week.”

Other commentators have pointed out that the picture of the housing market can vary widely depending on the location.

“If you’re thinking about buying a property in this fast-changing environment, one of the best things you can do is to detach from the emotional dimension, so that you are able to analyse whether you are getting a good price and value for money,” said Anna Clare Harper, author of Strategic Property Investing.