Diane, a mother of two, knows what it’s like to be trapped on a mortgage that charges more than double the market interest rate.

Over 10 years, she has paid more than £55,000 more in interest than she would have paid on a competitive mortgage.

That’s far more than the arrears that she fell into that led her lender to start repossession proceedings in 2019.

“It’s had a long-term traumatic effect on me – on my mental health, on my emotional well-being,” she says.

“It’s robbed me of years that could have been good years with my children. Because it was constantly all about finding the next penny.

“You’re down to 10p in your bank account. You go without to try to make your children think it’s OK and that life is normal. But it takes a toll and you can’t hide it; they can tell.

“I was constantly worried about money, constantly worried about losing our home – about not having a home at all because of the shortage of social housing where I live.”

Over the past decade, Diane, who asked for her name to be changed in this article, has struggled with a mortgage at an interest rate of 4.99% – two to three times the rate she could get, were she able to re-mortgage at a competitive interest rate.

In 2006, she bought a house with a regulated mortgage from a High Street lender and a large deposit.

At the time, it didn’t look like a risky transaction, with plenty of equity cushioning the mortgage. But her equity was more than wiped out in the house price crash that followed the 2008 banking crisis.

In 2007, she contracted a debilitating illness that left her unable to work. Then her partner left her, leaving her to raise three young children alone on a meagre income from benefits.

Mortgage paradox

Yet from 2008, she was trapped on an expensive standard variable rate loan, paying more than double the interest rate she might have paid on a competitive mortgage deal.

“People who can afford to pay more can get mortgages meet the affordability rules so they can pay less with a cheaper mortgage of less than 2%. I’m paying £1,100 a month at 5% and you’re telling me I can’t afford to pay less?

“There’s got to be something wrong here. There’s this constant feeling of injustice.”

Up to 250,000 homeowners like Diane are “mortgage prisoners”, forced to pay standard variable rate mortgages which typically charge more than double the most competitive fixed and discount rates on the mortgage market.

A report published on Wednesday by the London School of Economics found the mortgage prisoners were up to 40% more likely than other borrowers to default in the pandemic.

Many end up paying tens of thousands of pounds more than the average borrower over time, leading to severe financial and emotional stress as borrowers struggle to keep their homes.

They are trapped because they cannot re-mortgage to a cheaper loan – for example, because their mortgages, taken out before the financial crash, are too large compared to the value of their home, or because they have built up arrears.

Affordability criteria introduced following the crash block them from getting new mortgages on cheaper rates – effectively telling homeowners they “can’t afford to pay less”.

Debt build-up

After falling ill, Diane was forced to rely on the key welfare benefit, but not before she ran up arrears of £8,000.

“I’m a professional person and I had a good life until I became ill.

“To have everything taken away from you… We had to get by on £130 a week; we still are.”

By penny-pinching and with help from family and friends, Diane was able to bring the mortgage arrears down to £2,000.

But then the benefit she was relying on was withdrawn and converted from a grant to a loan that has to be repaid.

Unable to manage £1,100 a month, she rapidly ran up arrears, and in November 2019 her lender started repossession proceedings.

As her home was threatened, her anxiety levels went through the roof. Then the pandemic struck.

“When you’re counting every penny, it makes you indecisive – I’d constantly ask myself, ‘Can I afford this?’ It changes you. You even lose contact with friends because you don’t want to be the depressed one – the one who can’t join in.

“You don’t want to talk about how little you have all the time. You no longer relate to your friends, because you’re in a different world.”

It took the intervention of MPs on the All Party Parliamentary Group for Mortgage Prisoners, led by Conservative MP Kevin Hollinrake, to prevent Diane and her family losing their home.

After months of pressure, her lender calculated what she would have paid, had she been offered a competitive mortgage.

The money she had over-paid over a decade was credited to her mortgage account, allowing her to stay in her home.

So large was her overpayment that it also wiped out her negative equity.

But thousands in the same predicament have no hope of the same relief – because the government sold their mortgages to private investment firms such as Cerberus that don’t offer new mortgages.

Government proposals

Treasury economic secretary John Glen is now considering new proposals to free hundreds of thousands of homeowners trapped on high-interest mortgages. He has promised to give them “full consideration”.

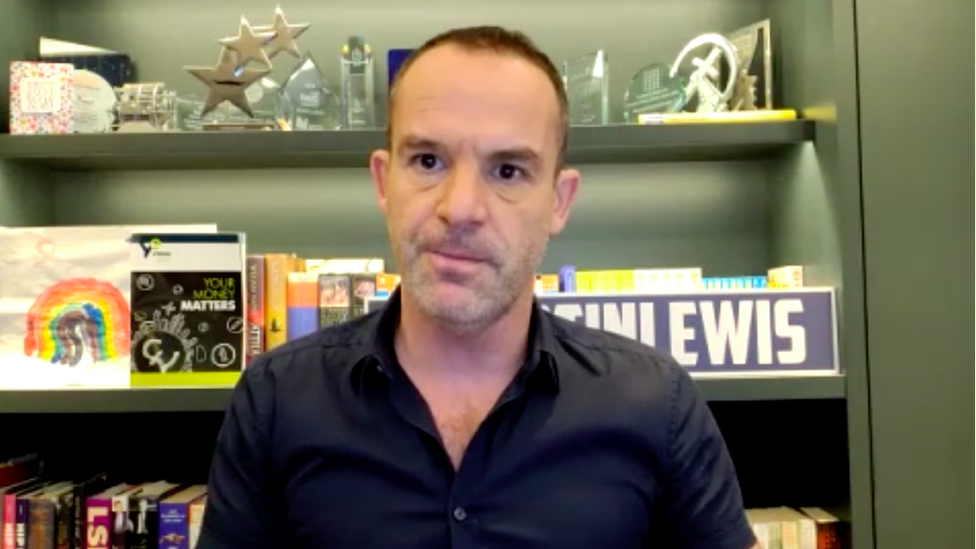

The proposals are put forward in the London School of Economics report, commissioned by financial campaigner Martin Lewis of MoneySavingExpert.

It says mortgage prisoners are 40% more likely to fall into arrears than normal borrowers and warns that financial stress is harming many borrowers’ mental health.

Many of the mortgage prisoners are also key workers on the front line of the pandemic.

It says the Treasury could help mortgage prisoners escape their predicament with policies including interest-free government equity loans and “mortgage rescue” – which would allow people to stay in their homes as tenants, while the property is sold to housing associations with a buy-back option later.

Mr Lewis said: “Mortgage prisoners are the forgotten victims of the 2008 financial crash.

“The government at the time chose to bail out the banks, but unfairly – immorally – hundreds of thousands of their victims were left without adequate help, trapped in their mortgages and the financial misery caused by it. And they have been forgotten ever since.

“There is a moral responsibility to release money to free mortgage prisoners from their penury.

“Intervention can and will save lives.”

A Treasury spokesperson said: “We know that being unable to switch your mortgage can be incredibly difficult.

“Thousands of borrowers will now find it easier to switch to an active lender or continue interest-only payments thanks to recent rule changes by the Financial Conduct Authority – and we have been working closely with the industry to ensure more is done to help those who are eligible to switch.

“We remain committed to looking for practical new solutions for borrowers who are struggling.”