House hunters are taking advantage of lockdown rules to travel hundreds of miles to view homes, according to estate agents.

Many buyers are keen to take advantage of the stamp duty holiday which is due to end on 31 March.

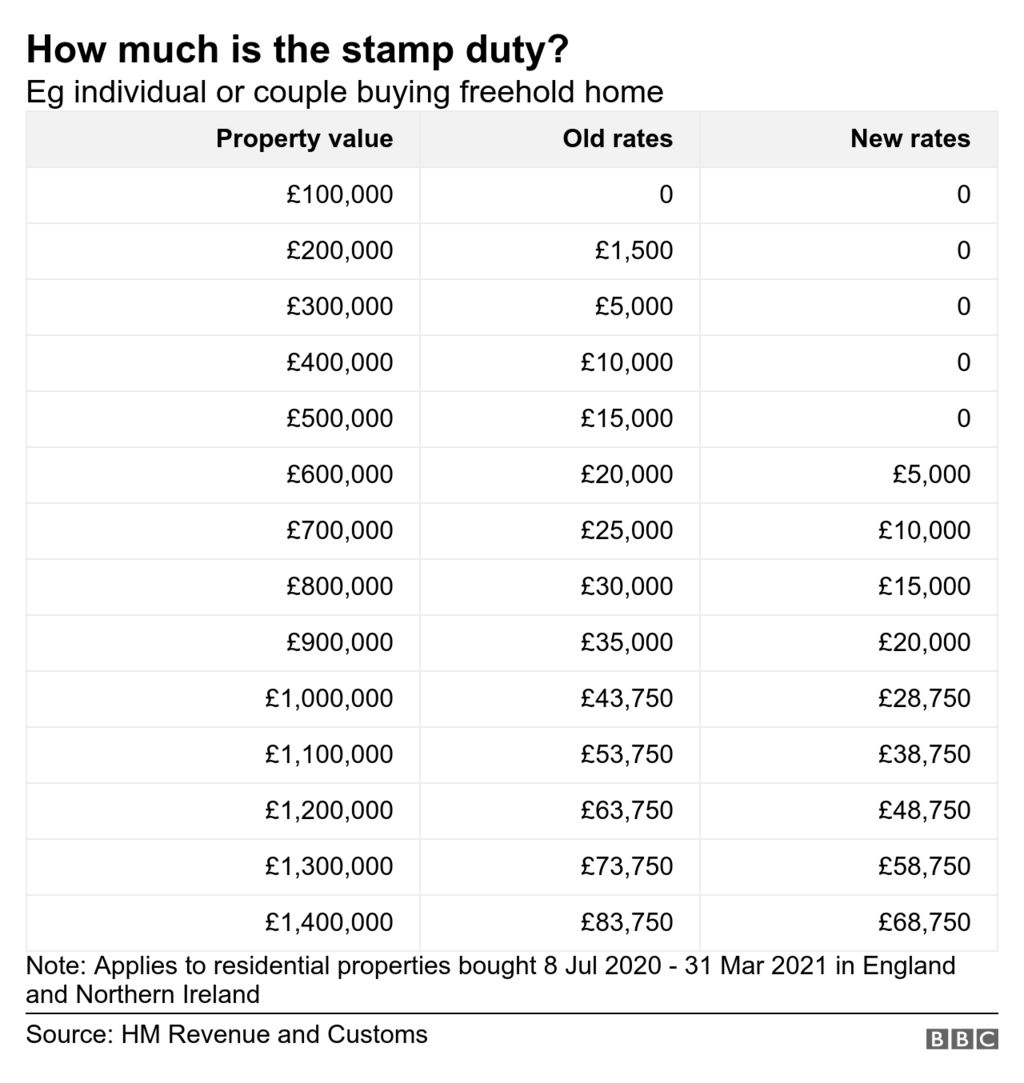

In July, the government suspended stamp duty on the first £500,000 of all property sales in England and Northern Ireland to help boost the market.

What is stamp duty?

Stamp duty is a tax paid by people buying properties, although it varies slightly across the UK.

In England and Northern Ireland buyers pay Stamp Duty Land Tax.

In Scotland it is Land and Buildings Transaction Tax, while in Wales buyers pay Land Transaction Tax.

The amount paid to the government depends on where you are in the UK, and the price of the property.

What has changed?

The government has temporarily increased the stamp duty threshold to £500,000 for property sales in England and Northern Ireland, until 31 March 2021.

Anyone completing a purchase on a main residence costing up to £500,000 before the deadline will not pay any stamp duty, and more expensive properties will only be taxed on their value above that amount.

This can save buyers as much as £15,000, if they are buying a property of £500,000 or more.

The move was aimed at helping buyers who have taken a financial hit because of the coronavirus crisis.

It was also intended to boost a property market hit by lockdown, which had seen house prices fall for four months in a row.

The average stamp duty bill will drop by £4,500, Mr Sunak suggested, with nearly nine out of 10 people buying a main home in 2020 expected to pay no stamp duty at all.

However, critics worry it could encourage people who were planning to buy later in 2021 to accelerate their plans to take advantage of the tax break. This could lead to a slump in demand when the tax break ends.

How much stamp duty will I pay?

If the property purchased is your main home, you won’t pay any stamp duty at all if it costs £500,000 or less.

The next portion of the property’s price (£500,001 to £925,000) will be taxed at 5%, and the £575,000 after that (£925,001 to £1.5m) at 10%.

The remaining amount (over £1.5 million) will be taxed at 12%. You can calculate how much you are liable to pay here.

Before the announcement, stamp duty in England and Northern Ireland was paid on land or property sold for £125,000 or more, while first-time buyers did not pay any stamp duty up to £300,000. But this stamp duty holiday replaces that first-time buyer discount.

Landlords and second-home buyers are also eligible for the tax cut, but will still have to pay the additional 3% of stamp duty they were charged under the previous rules.

What about Scotland and Wales?

In Scotland, the normal rates on Land and Buildings Transaction Tax are:

- 2% on £145,001-£250,000

- 5% on £250,001-£325,000

- 10% on £325,001-£750,000

- 12% on any value above £750,000.

However, until the end of March, the threshold at which the tax starts to be paid has been raised to £250,000, under measures brought in by the Scottish government.

Scottish landlords pay an extra 4% Land and Buildings Transaction Tax on top of standard rates.

In Wales, the normal rates on Land Transaction Tax are

- 3.5% on £180,001-£250,000

- 5% on £250,001-£400,000

- 7.5% on £400,001-£750,000

- 10% on £750,001-£1.5m

- 12% on any value above £1.5m.

However, the Welsh government also introduced a temporary relief on the first tier, meaning that until the end of March people buying their main homes in Wales costing less than £250,000 will not pay any tax.

Welsh landlords pay an extra 4% Land Transaction Tax on top of standard rates.

How much does stamp duty raise?

The government’s annual take from stamp duty is around £12bn, according to the latest figures released by HM Revenue and Customs (HMRC).

That’s roughly equivalent to 2% of the Treasury’s total tax take.

The nine-month stamp duty holiday in England and Northern Ireland – from July 2020 to March 2021 – will cost the Treasury an estimated £3.8bn.