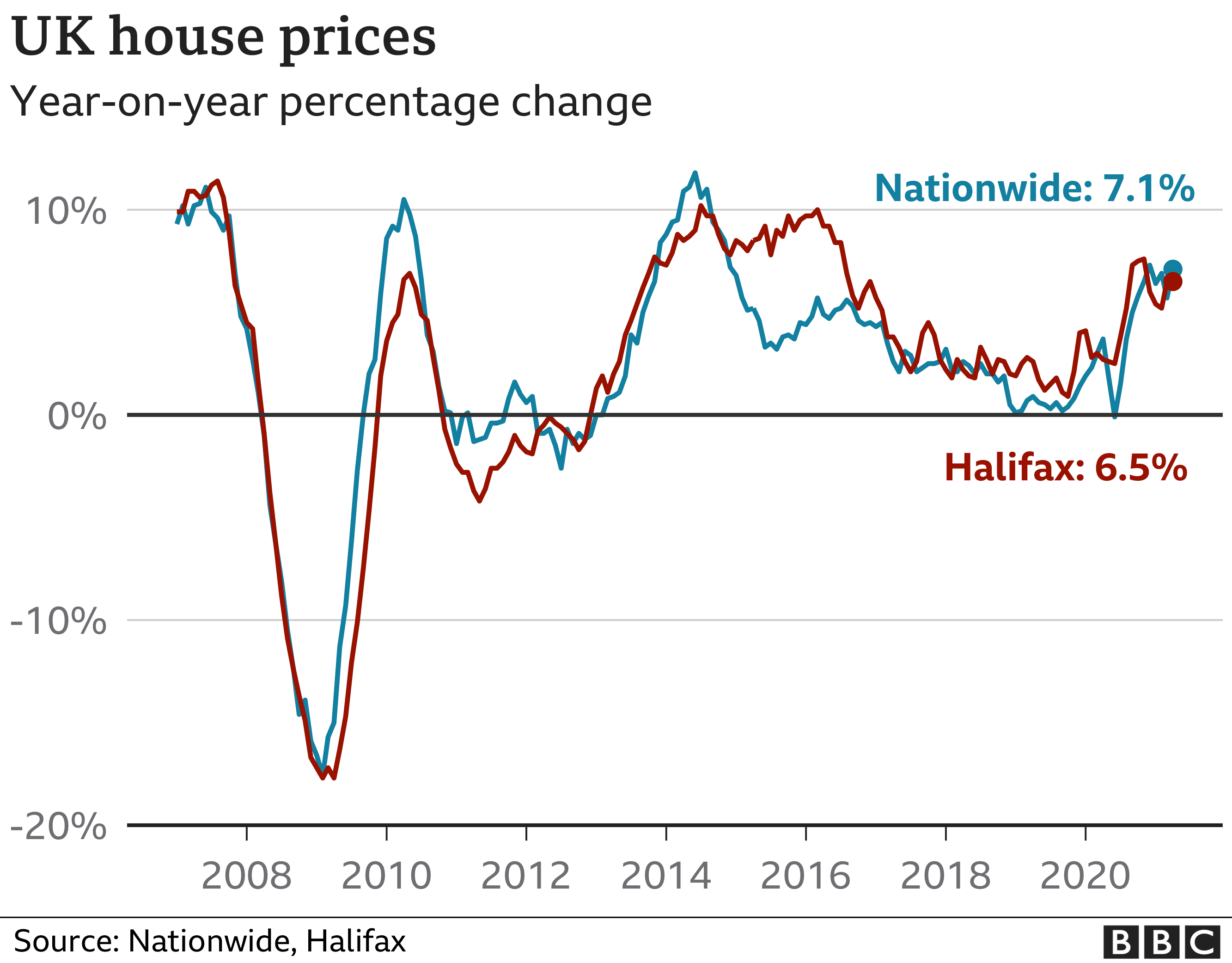

UK house prices rose by 7.1% compared with a year ago, the Nationwide has said, prompting one analyst to suggest the market is “on the boil”.

The building society said the average property price had risen by £15,916 in the last year, to reach £238,831.

The Nationwide said increased savings during lockdown meant some first-time buyers would be better placed to afford a home.

But prices could continue to rise as homes available did not match demand.

Lucy Pendleton, from independent estate agents James Pendleton, said: “This market is on the boil.

“Silly season might be just around the corner. That’s when a seller’s market becomes entrenched against a backdrop of very high demand and you start to see open houses for properties that are nothing special and a return of gazumping.”

The Nationwide said that prices rose sharply in April, up by 2.1% compared with March.

Year-on-year price growth accelerated as well, driven in part by the extension in stamp duty holidays in England, Wales and Northern Ireland.

The pandemic has led some people to reassess their domestic set-up, with demand for more space coming to the fore.

“Our research suggests that while the stamp duty holidays is impacting the timing of housing transactions, for most people it is not the key motivating factor prompting them to move in the first place,” said Nationwide’s chief economist, Robert Gardner.

The state of the market saw some people queuing overnight outside an estate agent in Wales as homes for a new development went onto the market.

Nationwide’s figures are based on its own mortgage data, and it suggests that the market is likely to continue to be busy for the next six months, owing to the stamp duty relief.

Price growth was also likely to accelerate, it said, with demand expected to exceed the supply of homes on the market.

Savings boost

That is generally bad news for first-time buyers, but the building society said some – with the help of their families – would be in a better position having had the opportunity to save money during the pandemic.

A typical first-time buyer would need to save £19,500, or around 50% of their gross earnings, for a 10% deposit on a mortgage, Mr Gardner said.

“The fact that around a third of first time buyers in England in 2018-19 said that friends or family helped them to raise a deposit through a loan or gift suggests that the recent surge in savings will help some, but that the impact won’t be spread evenly,” he said.

On the same day, Barclays boss Jes Staley said that built-up savings would help to create the biggest economic boom since the aftermath of World War Two in the UK.

The Nationwide said that the longer-term outlook for the housing market was more “uncertain”.

“If unemployment rises sharply towards the end of the year as most analysts expect, there is scope for activity to slow, perhaps sharply,” Mr Gardner said.

Nicky Stevenson, managing director at estate agent Fine & Country, said: “Numbers like this won’t last forever but the market may not begin to unwind until the busy summer season is out of the way.”