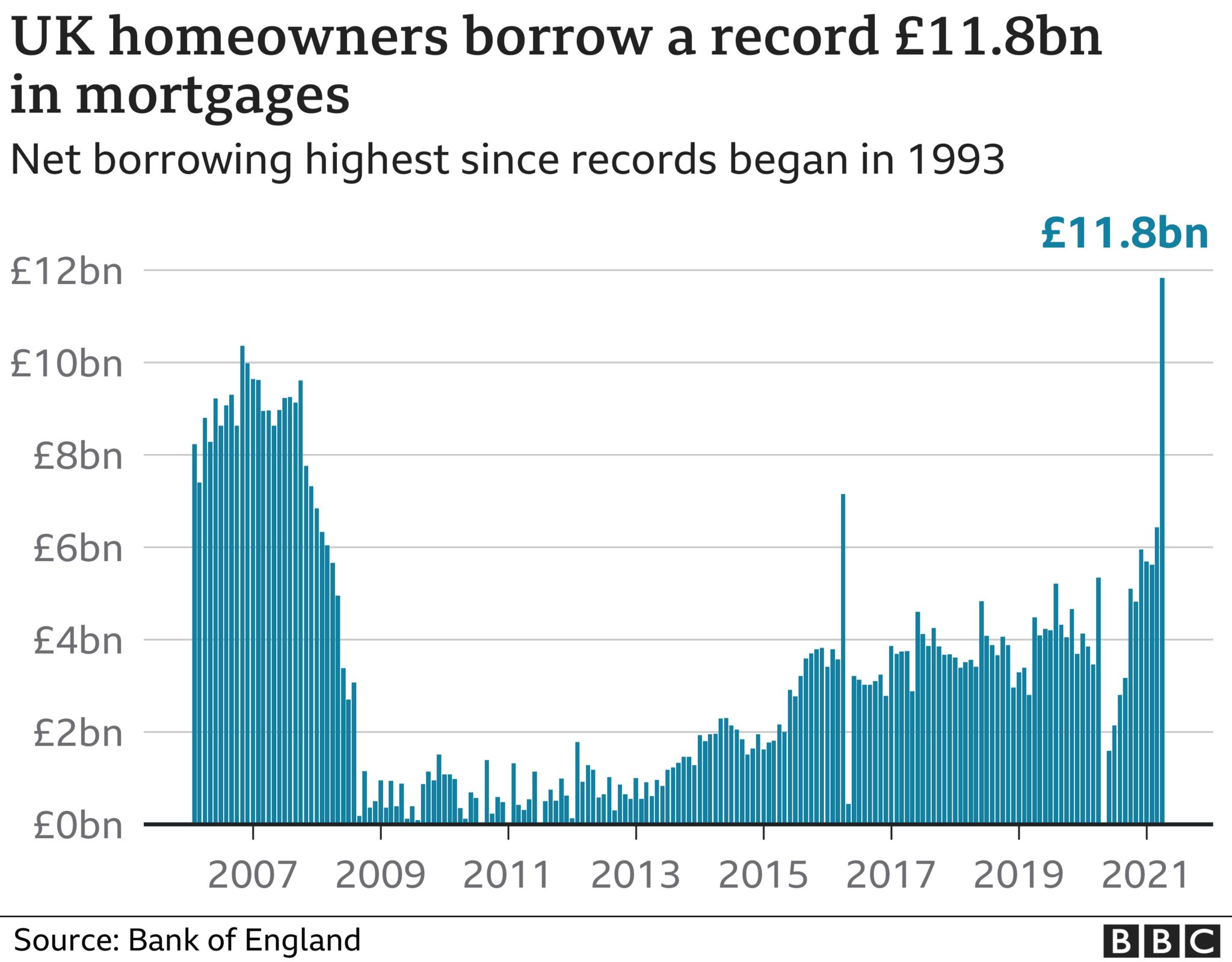

UK homeowners borrowed a record £11.8bn more on mortgages than they repaid in March, according to figures from the Bank of England.

This net borrowing level was the highest of any month since comparable data began in 1993.

The market was stoked up by stamp duty holidays and by low mortgage rates.

These factors encouraged some homeowners to move in time to beat the tax relief deadline or to borrow more to improve their current property.

Mortgage borrowing signals future demand to buy homes, and analysts have said that the UK housing market has been “on the boil” during the spring.

On Friday, the Nationwide Building Society said the average property price had risen by £15,916 in the year to the end of April, to reach £238,831.

Gross mortgage borrowing hit £35.6bn in March as some people tried to beat the end of the stamp duty holidays, which were then extended in England, Wales and Northern Ireland.

Andrew Montlake, from mortgage broker Coreco, said stamp duty relief was having an “insane effect” on the property market.

“This mad March mortgage data highlights the frenzied rush of people to buy in the second half of last year and save thousands of pounds on stamp duty,” he said.

“But the celebrations surrounding the stamp duty holiday may soon ring hollow if the market cools off and people find their savings have been wiped out by the premium they have paid for property. When borrowing is as extreme as this, it never tends to end well.”

New scheme

In April, some High Street lenders started selling mortgages to borrowers offering a deposit of just 5% under a new government guarantee scheme aimed at helping first-time buyers.

The new scheme will be available to anyone buying a home costing up to £600,000, unless they are buy-to-let or second homes.

The government is offering a partial guarantee, generally of 15%, to compensate lenders if the borrower defaults on repayments.

House hunters, particularly first-time buyers, might be helped in their quest to have enough for a deposit by families and individuals saving more. The Bank of England said deposits into accounts “remained strong in March”. Some £16.2bn more was deposited than withdrawn, the data shows.

Households also continued to pay back more than they borrowed on non-mortgage debt in March, the Bank said. A net consumer credit repayment of £535m was recorded, including people’s borrowing using credit cards, personal loans and overdrafts.