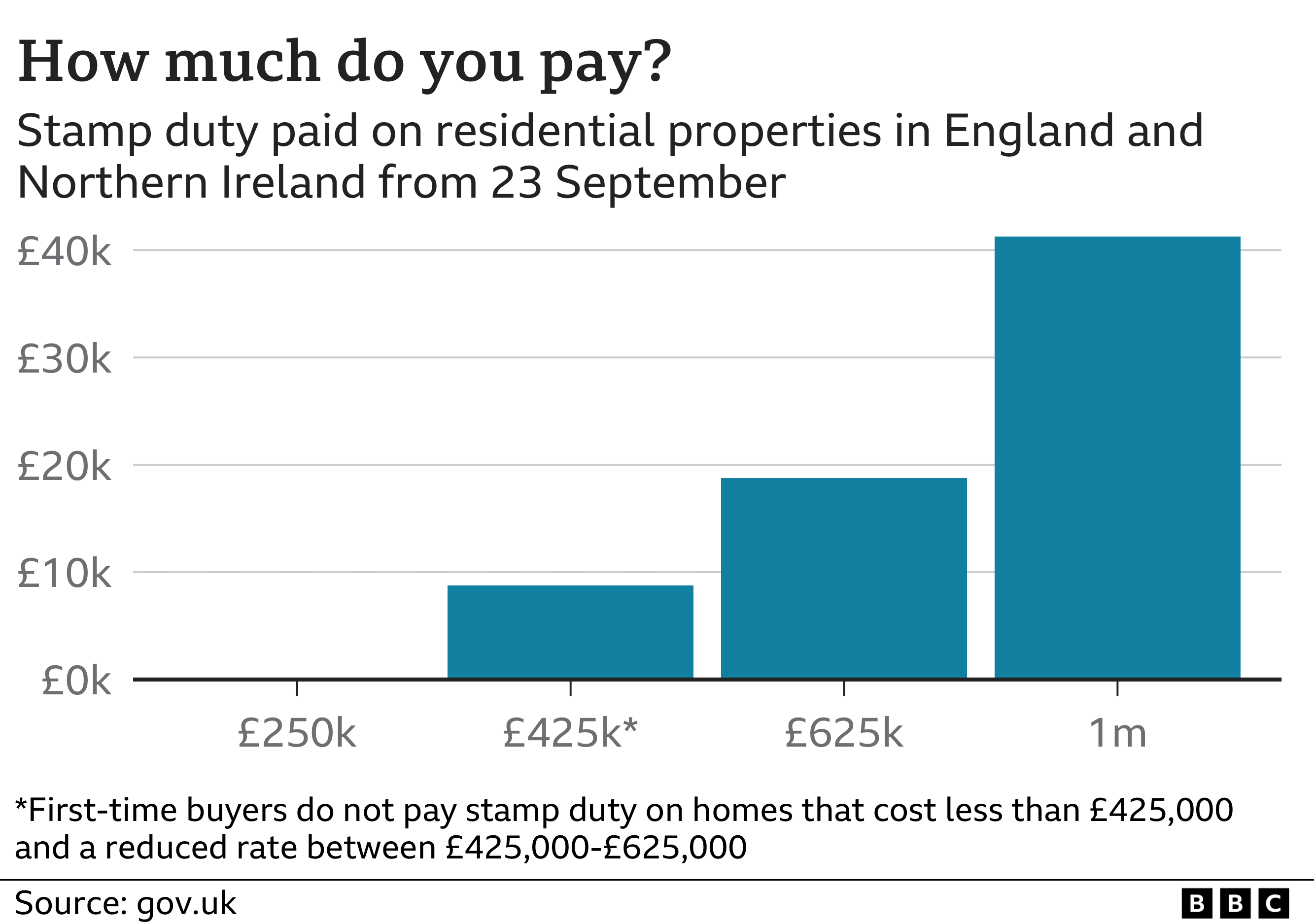

The government has announced a cut to stamp duty, the tax paid when people buy a property in England and Northern Ireland.

The threshold at which the tax falls due has been raised to £250,000 from its current £125,000 level.

Meanwhile the threshold for first-time buyers has been increased from £300,000 to £425,000.

The changes should remove 200,000 people from having to pay stamp duty, Chancellor Kwasi Kwarteng said.

The chancellor also increased the value of the property on which first-time buyers can claim stamp duty relief from £500,000 to £625,000.

A buyer splashing out £500,000 on a home will now be charged £12,500 rather than the previous £15,000.

“Home ownership is the most common route for people to own an asset, giving them a stake in the success of our economy and society,” Mr Kwarteng told the Commons as he presented his mini-budget.

“This is a permanent cut to stamp duty, effective from today.”

Different rates apply in Scotland under the Land and Buildings Transaction Tax, and in Wales with the Land Transaction Tax.

Under the changes announced by the chancellor, anyone spending £250,000 on a property in England or Northern Ireland will avoid £2,500 in stamp duty charges as it was previously charged at 2% between £125,000 and £250,000.

Anyone other than first-time buyers spending £300,000 will now be charged £2,500, rather than the previous £5,000.

However, some first-time buyers said the increase in the stamp duty threshold would not help.

Sarah Johnson, 26, is a hairdresser in Chester who has managed to save £8,000 in five years towards buying a first home.

But the cut in stamp duty won’t help her as she would not have paid any anyway. Instead she is worried it will just push up house prices even more.

” House prices are just crazy at the moment and I think this is just going to make them more ridiculous,” she says.

“I’m just trying to ignore it at the moment and hoping everything will crash and the prices will go down.

“When my mum bought her first house she says it was £50,000. I wish it was like that now because I could buy a house tomorrow!”

However, London estate agent Jeremy Leaf said: “The stamp duty cut should encourage those at the first rung of the housing ladder to take the plunge.

He said that would be good not just for the market but for job and social mobility across the board, as well as the wider economy.

But rising interest rates, which will mean more costly mortgages, are set to weigh on the housing market, said Tom Bill, head of UK residential research at Knight Frank.

“Many buyers will find the impact of rising mortgage rates soon eclipses the benefit of a stamp duty cut, which will keep firm downwards pressure on prices next year.”