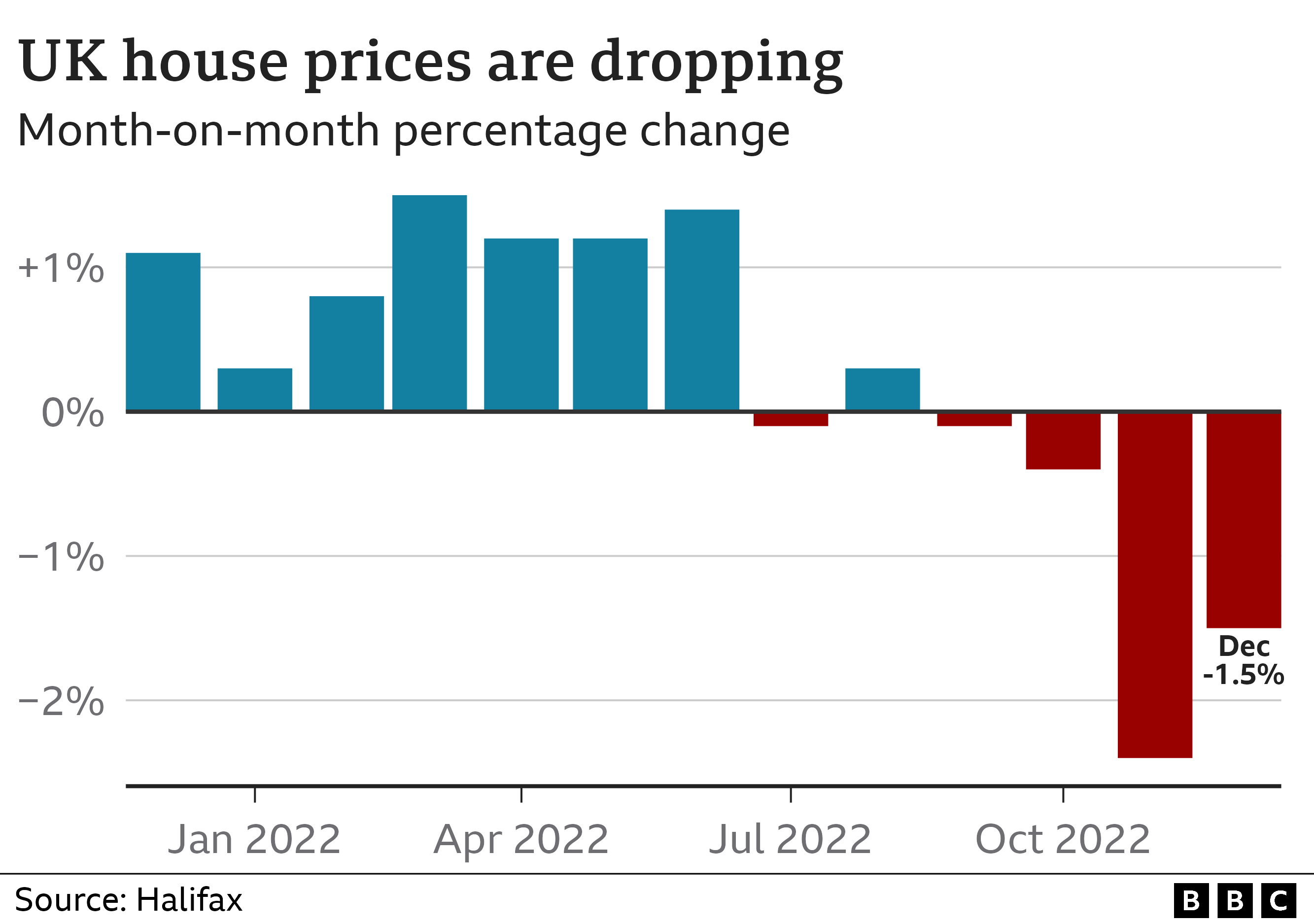

The average house price in the UK fell for the fourth month in a row in December, as the rising cost of living and higher interest rates hit home.

December prices fell by 1.5% compared to November, meaning the average house price is now £281,272, said Halifax.

The bank said uncertainty about how the cost of living will affect household bills, as well as rising interest rates, is slowing the housing market.

It expects buyers and sellers to “remain cautious” over the coming year.

December’s monthly fall was lower than the decline of 2.4% seen in November, even taking into account the expected seasonal slowdown, said Halifax mortgages director Kim Kinnaird.

On an annual basis, house prices grew by 2% compared with December 2021 – the slowest rise since October 2019 when prices increased at an annual rate of 1.1%.

It was also sharply lower than the 4.6% annual increase seen in November.

Rising interest rates have weighed on the housing market. The Bank of England has increased rates nine times since December 2021 to try to dampen the rate of price rises, also known as inflation. Interest rates are currently 3.5%, the highest level in 14 years.

And while mortgage rates have fallen since the government’s controversial “mini budget” last September they are still higher than they were at the beginning of 2022.

Ms Kinnaird said: “As we enter 2023, the housing market will continue to be impacted by the wider economic environment and, as buyers and sellers remain cautious, we expect there will be a reduction in both supply and demand overall, with house prices forecast to fall around 8% over the course of the year.”

However, she said, the cost of the average home remained high, and even if prices did drop by 8% that would mean the cost of the average property returning to April 2021 prices, still “significantly above” pre-Covid levels.

Alice Haine, personal finance analyst at investment platform Bestinvest, said while the high mortgage rates seen in October had now eased and property prices were on the decline “affordability is still a challenge for many as prices are still above pre-pandemic levels and household finances continue to grapple with the wider cost-of-living crisis”.

Martin Beck, chief economic adviser to the EY Item Club forecasting group, said the four months of falling prices was the “weakest run since 2008, when the impact of the global financial crisis was building”.

Property prices were likely to continue falling for the “foreseeable future”, he said, declining by about 10% over the next 12-18 months.

Mr Beck added that if the Bank of England raises interest rates again in February that could push up borrowing costs again.

“Cost of living pressures are cutting households’ spending power and will be exacerbated by tax rises and a reduction in the generosity of the cap on energy bills in April. Meanwhile consumer confidence is very downbeat,” he said.

All UK nations and regions saw annual house price inflation cool down in December.

The biggest slowdown in growth was in the North East of England, where prices were up by 6.5% in December, against a rise of 10.5% in November. The average house price in the region is now £169,980.

The Halifax house price index has been going for 40 years. When the index began in January 1983 the average UK house price was £26,188 and interest rates stood at 11%. Since then, average house prices have gone up by 974% to £281,272.

The peak in prices came in August 2022, Halifax said, when the average price hit £293,992.