House prices have fallen in recent months, with increased interest rates making mortgages more expensive and high inflation reducing people’s spending power. However, although Bank of England interest rates have gone up for the 10th time in a row, some mortgage rates have started to fall.

What is happening to house prices around the UK?

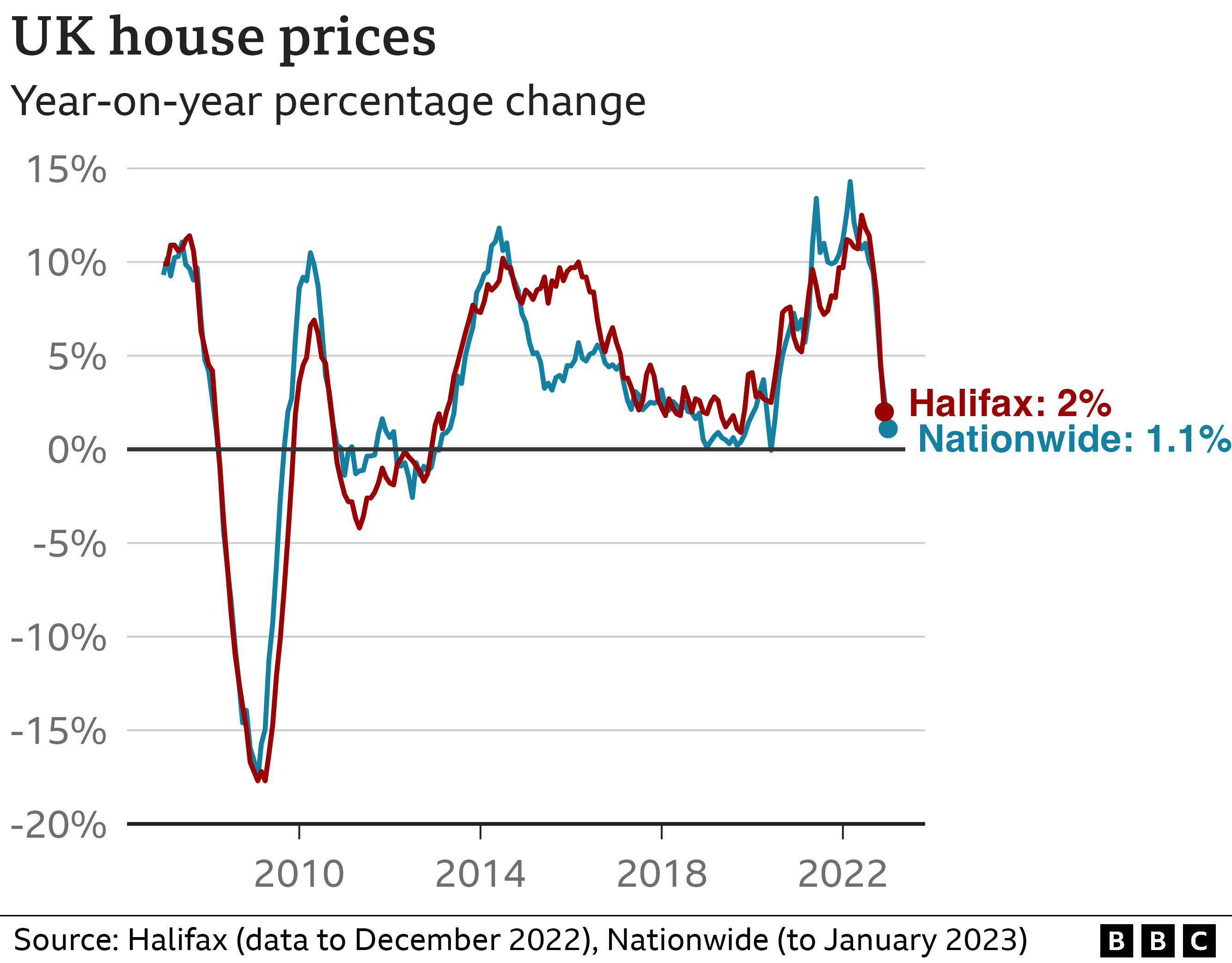

In 2021 and for much of 2022, prices rose steeply – by about a quarter – across most of the UK.

The pace of growth was much faster than was seen during the recovery after the 2008 global financial crisis.

However, figures from Nationwide and Halifax show consistent falls in the last five months.

The chart above shows that year-on-year growth is heading down towards zero.

Nationwide warned the housing market looked set to “remain subdued” in the coming months.

You can use the chart below to compare what’s happened to house prices in different parts of the UK.

Most regions and nations around the UK saw growth from 2015 until the second half of last year.

Some regions like East Anglia and the North East of England have seen prices flatten out rather than falling in the second half of 2022.

And London, which saw prices fall slightly during the pandemic, hasn’t seen falling prices yet.

Monthly changes can be blips, but the UK’s largest lender, Lloyds, is planning for an 8% fall in 2023.

In November, the Office of Budget Responsibility (OBR), which advises the government on the health of the economy – predicted that house prices will drop by 9% over the next two years.

Big jumps in interest rates have put pressure on the amount people can afford to borrow.

In turn that means lower offers and less demand for homes overall.

The amount people can spend of their mortgage also depends on wider cost-of-living pressures, such as energy bills, wages and job security. The future of house prices depends on the economy as a whole.

What happens when house prices fall?

The biggest immediate effect is on people who want to move. Some sellers may decide to delay putting their homes on the market. Homeowners who are considering moving may find they have less money to spend. There were fewer property sales in 2022 than in the 12 months leading up to last summer’s surge in prices, before the temporary stamp duty reduction ended. But if interest rates stay high, an increasing number of people will come off fixed-price mortgages (about 100,000 each month) to new, higher rates. Some homeowners will find higher these monthly payments unaffordable, making them more likely to sell.