So what can those struggling to make repayments do – and how must their mortgage provider help out?

How have tracker, variable and fixed mortgages changed?

There are different types of mortgages – all of which have become more costly in recent months.

- Tracker rates rise and fall in line with the benchmark interest rate the Bank of England set eight times a year.

- Standard variable rates (SVR) change at the discretion of the lender – a decision influenced by the Bank of England’s rate but not directly linked

- Fixed rates, used by about three-quarters of mortgage customers, are set for a certain number of years – usually two or five – after which borrowers remortgage, or are automatically moved to an SVR

Mortgage rates have risen and the 1.6 million people on tracker or variable deals are paying much more than a year ago.

The estimated 1.8 million homeowners coming to the end of a fixed deal this year face moving to a much higher monthly bill.

What next for mortgage rates?

That is difficult to answer. Some think the Bank of England won’t raise rates any further, whereas others predict they will peak at 4.5% this summer.

If rates do rise again, anyone on tracker deals will face higher repayments.

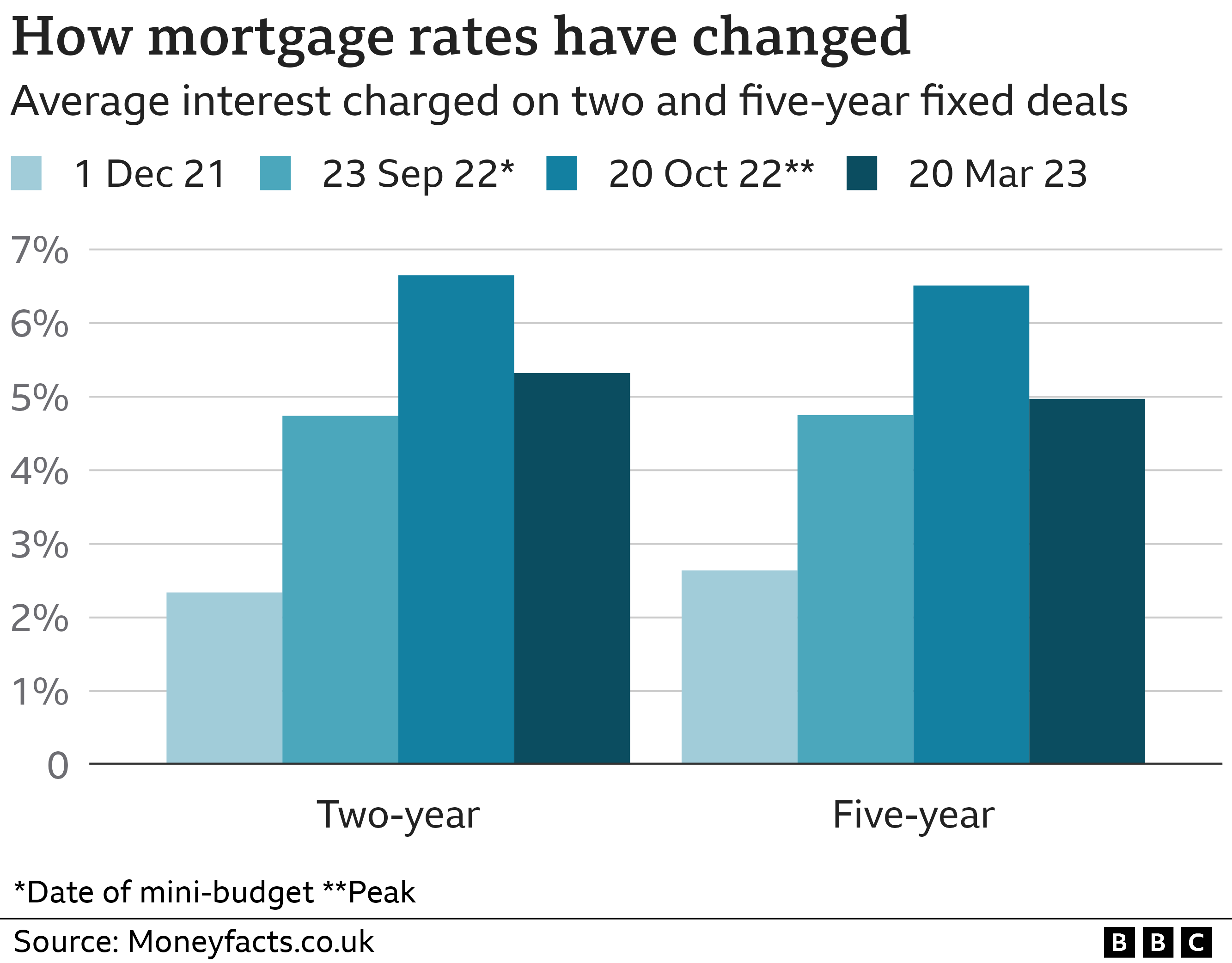

Recent data indicates that rates on fixed-rate deals have fallen back after surging last year.

House prices have also started to fall as higher interest rates put off buyers.

The government’s official forecaster, the Office for Budget Responsibility, suggested that UK house prices will fall by 10% by 2024 compared with last year’s peak.

A decade or so of ultra-low mortgage rates – which many homeowners have become accustomed to – is clearly over.

Will mortgages be difficult to secure?

There is a smaller choice, but still plenty of options depending on your circumstances.

An agreement between lenders, the Treasury and regulators means people can switch to a new fixed-rate mortgage, without a new affordability test, when their current deal ends, as long as they are up to date with payments.

A shortfall equivalent to two or more months’ repayments means you are officially in arrears.

But your lender must make reasonable attempts to reach an agreement with you.

In fact, the Financial Conduct Authority (FCA) – which regulates mortgage lenders – has said they must treat customers fairly.

Crucially, customers must contact their lender as soon as they realise they are going to struggle to make repayments – the earlier the better. Trained and experienced staff must be on hand to help.

What must my lender do initially?

Within 15 working days of falling into arrears, your lender must:

- Tell you how much your arrears add up to

- List the missed payments

- Explain how much is outstanding on the mortgage

- Outline any charges

Your lender must then treat you fairly by considering any requests about changing how you pay, perhaps with lower repayments for a short period.

Any arrangement you come to, the FCA points out, will be reflected on your credit file – affecting your ability to borrow money in the future – as will any missed payments.

Your lender might also suggest or allow you to extend the term of the mortgage or let you pay just the interest for a certain period of time.

Can I take a mortgage holiday?

A mortgage payment holiday enables customers to delay repayments – but not indefinitely.

Lenders may offer this option, depending on individual circumstances – and not to those already in arrears – but the level of support offered during the Covid pandemic has been reduced.

Again, this will show on your credit file.

The devolved governments run some mortgage-support schemes – but the criteria can be complex.

Could I lose my home?

Some people may decide to sell their home and – in extreme circumstances – the lender could take court action to repossess it.

Repossessions are far rarer than they used to be.

There are lots of stages before a lender can take such action and the whole process takes about two years.

But if you think your home is at risk, it is well worth getting free independent debt advice. Visit: www.gov.uk/national-debtline