House prices have ended the year 1.8% lower, according to Nationwide which forecasts no growth or a further fall in 2024.

The lender said the average house price across the UK was £257,443 in December.

This was flat compared to November but down compared to December last year.

Nationwide said consumer confidence “remains weak”, despite some mortgage rates starting to fall in anticipation the Bank of England could cut borrowing costs in the coming months.

The number of housing transactions has been running at around 10% below pre-Covid levels, the lender said.

The drop was more pronounced for those buying a house using a mortgage – down 20% compared to before the pandemic.

However, the volume of cash deals continues to run above the levels recorded before Covid hit.

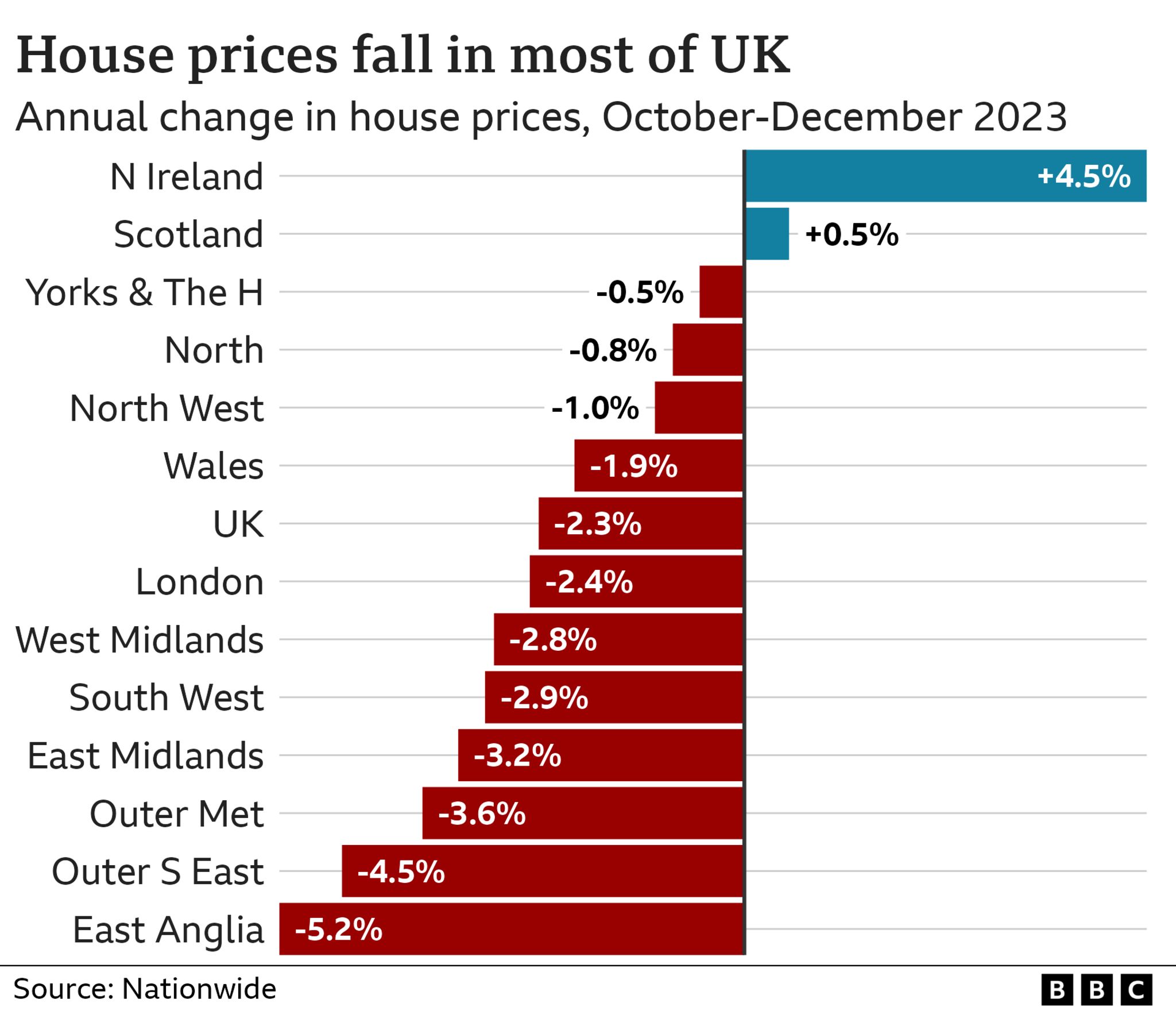

Only Northern Ireland and Scotland recorded house price growth for the last three months of this year.

In Northern Ireland, the average house price rose by 4.5% to £184,593 between October and December. In Scotland it edged up 0.5% to £179,208.

Wales saw a 1.9% decline to £201,730, while across England overall, prices were down 2.9% compared last year to £296,231, with East Anglia the worst performing area due to a 5.2% drop, bringing the average house price to £270,903.

Nationwide bases its survey data on its own mortgage lending and therefore does not include those who purchase homes with cash or buy-to-let deals.

But it looks at other sources of data to track wider market trends including cash buyers such as people who sell one home to buy another, without taking out a mortgage and those who buy with a prior sale, using cash.

According to the latest available official data, cash buyers currently account for more than a third of housing sales.

Looking ahead, Nationwide said: “There have been some encouraging signs for potential buyers recently, with mortgage rates edging down.”

The Bank of England has held interest rates at 5.25% in its past three meetings after a succession of rises to bring down inflation, which measures the pace of price rises.

Inflation has fallen sharply to 3.9% in November, average pay has been rising and house price growth is down. However, within that food prices remain relatively high at 9.2%, according to recent data from the Office for National Statistics (ONS).

Nationwide said: “This hasn’t been enough to offset the impact of higher mortgage rates, which in recent months were still more than three times the record lows prevailing in 2021 in the wake of the pandemic.

“As a result, housing affordability has remained stretched,” said Robert Gardner, chief economist at Nationwide.

Consumer confidence

Financial markets are forecasting that interest rates could start to be cut as soon as next May, which has encouraged some banks to trim mortgage rates.

But with 1.6 million deals expiring next year, according to banking trade body UK Finance, many mortgage holders could be rolling off cheap fixed-rate deals on to products with much higher rates, meaning monthly repayments could rise sharply.

“This has potential to cause a ‘shock to the system’ for some homeowners,” said Nathan Emerson, chief executive of Propertymark, a membership body for estate agents.

Mr Gardner said “consumer confidence remains weak and surveyors continue to report subdued levels of new buyer enquiries”.

Consequently, he said: “If the economy remains sluggish and mortgage rates moderate only gradually, as we expect, house prices are likely to record another small decline or remain broadly flat, perhaps 0% to -2% over the course of 2024.”