Mortgage lenders have started the year by cutting rates, taking some of the pain out of the cost of a new deal for homeowners.

The UK’s biggest lender, the Halifax, has cut some interest rates by close to one percentage point, with brokers now expecting others to follow suit.

HSBC has announced it will make cuts on Thursday, in what is being described as a “fast-moving market”.

But homeowners are being warned to pay close attention to what is offered.

“When lenders make big rate cuts, they do not generally reduce all of the products by the same amount,” said Aaron Strutt, from broker Trinity Financial.

Rate expectations

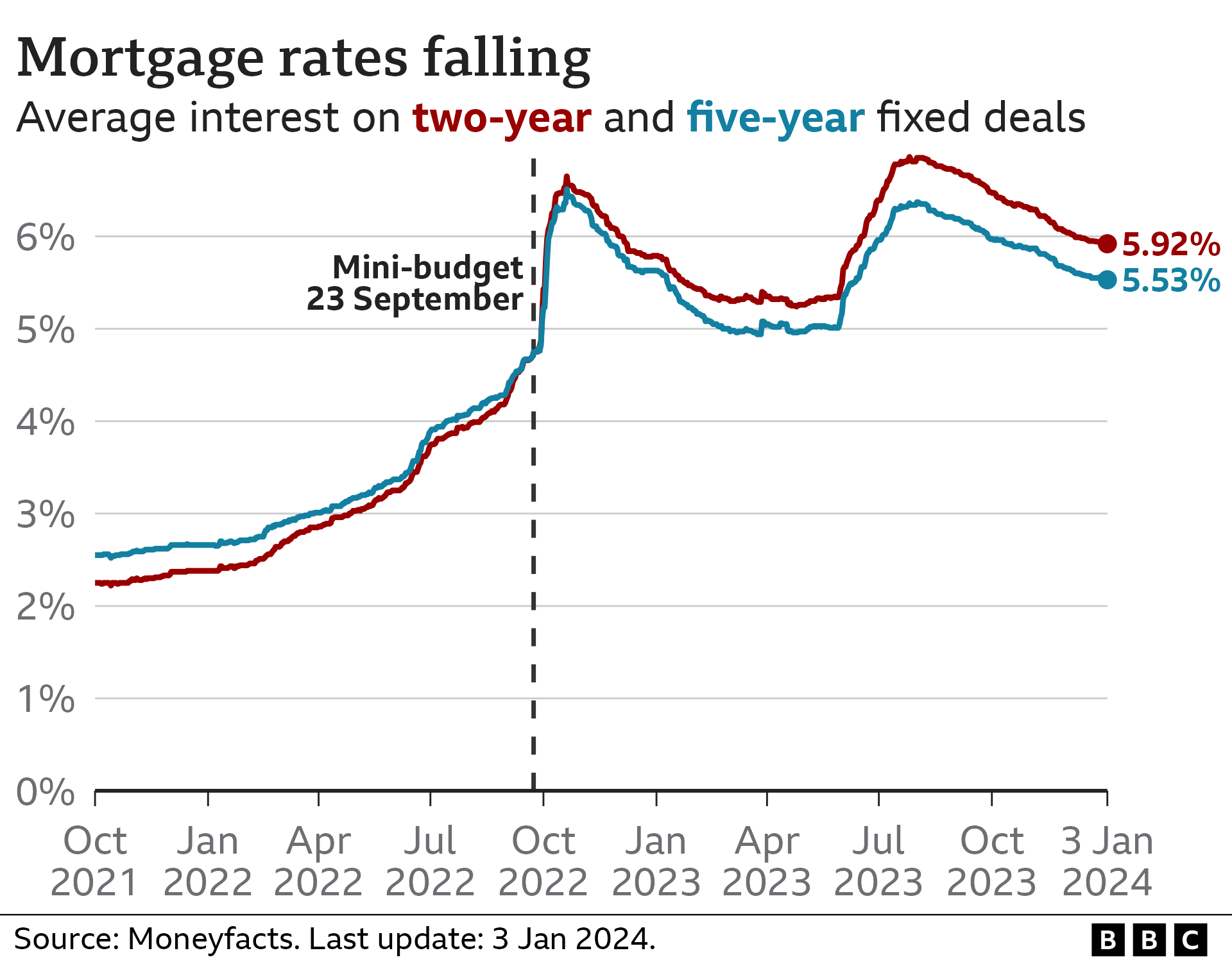

Mortgage rates will remain higher than many people have been accustomed to because of significant changes over the last two years.

The interest rate on a fixed mortgage does not change until the deal expires, usually after two or five years, and a new one is chosen to replace it. Doing nothing would leave people on a variable rate, which are very expensive.

Some 1.6 million homeowners will see their current fixed-rate deal expire over the next 12 months, the vast majority of whom could see their monthly repayments rise quite sharply.

However, competition between lenders means the financial pain may not be as intense as some would have feared.

Halifax is reducing its rates, with interest on a two-year fixed deal being cut by up to 0.83 of a percentage point. HSBC will follow on Thursday with a two-year fixed rate for remortgages (for someone with at least 40% equity in their home) falling below 4.5% for the first time since early June last year.

David Hollingworth, associate director at broker L&C Mortgages, said: “These cuts are just the latest salvo in an increasingly fast-moving market. These rates are offering some of the lowest rates since the spike in rates last summer.

“Although borrowers coming to the end of their current fixed rate this year will still be looking at a rise in payments, these new lower rates will at least take some of the sting out of the inevitable rise.

“Others will be bound to follow suit. We thought the new year would start with a bang and that’s proving to be the case.”

Lenders have been under pressure to reduce mortgage rates, because the cost of funding these home loans has dropped.

Although the Bank of England’s benchmark interest rate has been held three times at 5.25%, economists expect the next move to be a cut – an expectation that has already fed through to lenders’ calculations.

There is also competition to keep hold of existing custom with relatively little activity among new buyers.

“Banks and building societies will want the strongest possible start to the year, so it seems almost inevitable that more of them will improve their rates and fight it out to offer the cheapest deals,” said Mr Strutt.

He warned that people should look closely at the whole product.

Overall, the average rate on a two-year fixed mortgage has only dropped marginally in recent days, to now stand at 5.93%, according to the financial information service Moneyfacts.

The “best-buys” have dropped by about 0.8 percentage points in the last three months, it said.

Andrew Montlake, of mortgage broker Coreco, said: “How long [these cuts] continue remains to be seen, and whilst rates could still have some way to fall and the market will be more competitive once more, I suspect the pace of reductions to slow as the market finds a new normal to stabilise.”