Competition has intensified among mortgage lenders for people who are searching for a new deal, bringing some relief to those facing higher bills.

Brokers say that some lenders now have better options for those remortgaging than for those buying a property.

This will help people whose relatively cheap fixed-rate deal is coming to an end and are looking for a new one.

Two major lenders, Barclays and Santander, have announced further significant cuts.

The firms said they would reduce rates on some of their products on Wednesday by up to 0.82 percentage points.

Bills have risen

The interest rate on a fixed mortgage does not change until the deal expires, usually after two or five years, and a new one is chosen to replace it. Doing nothing would leave people on a variable rate, which is very expensive – with an average rate of more than 8%.

About 1.6 million existing borrowers have relatively cheap fixed-rate deals expiring this year. While their next deal is very likely to be more expensive, a series of cuts in rates by major lenders since the start of the year is set to ease some of that financial impact.

“It is interesting to see that some lenders are offering cheaper products for remortgages than for property purchases, which shows where they believe the market is at the moment,” said Andrew Montlake from mortgage broker Coreco.

“This is excellent news for those who have been worrying about coming off ultra-low mortgage rates into a higher rate environment and will help ease the pain with the jump being less than they may have feared.”

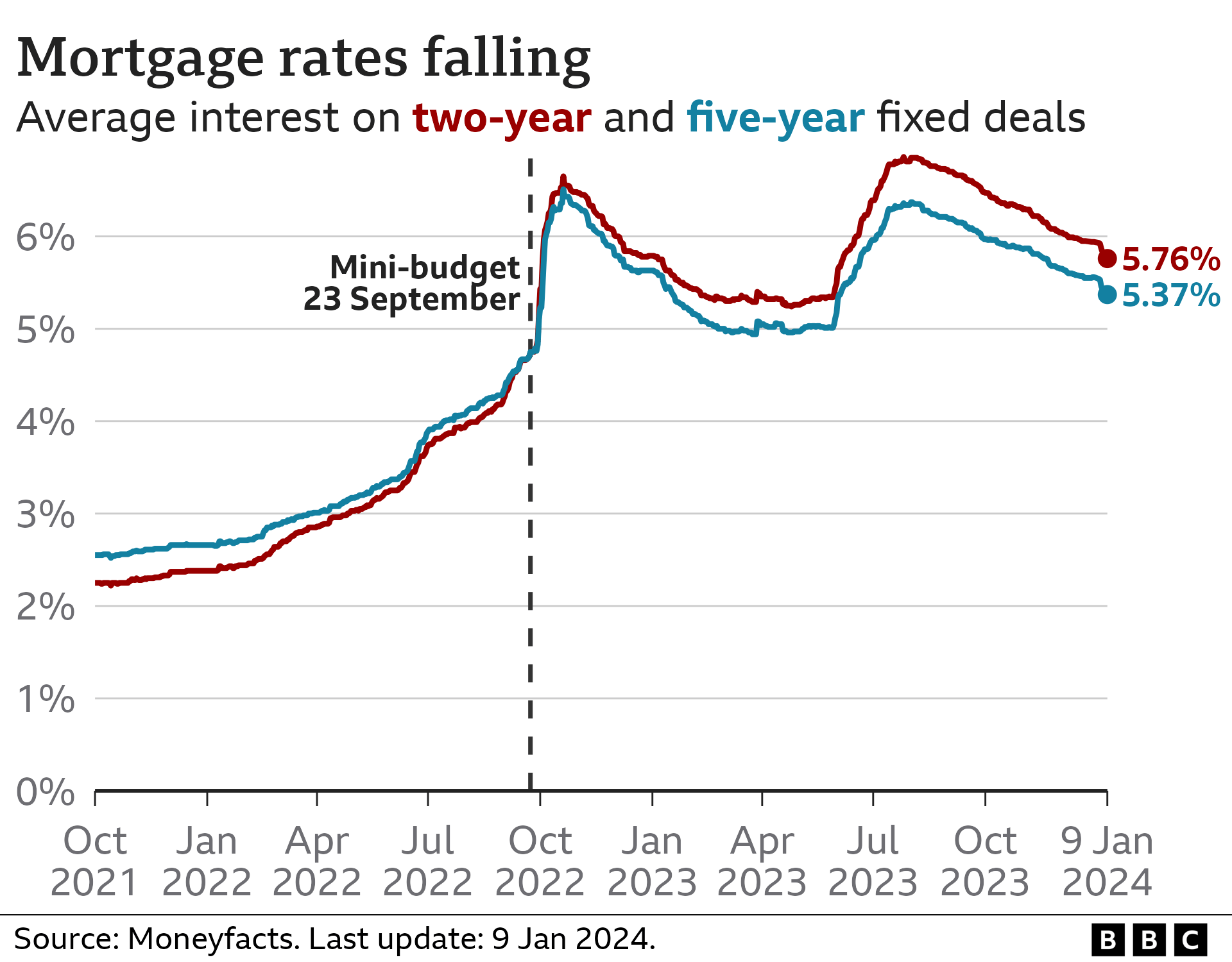

The financial information service Moneyfacts said the latest average rate for all new, two-year fixed mortgage deals has dropped sharply since the start of the year.

It now stands at 5.76%, down about a percentage point from last year’s peak.

For five-year deals, the average rate is now 5.37%.

The impact of relatively high mortgage rates is still likely to bring down house prices and increase arrears during this year, according to forecasters.

Changes in the mortgage market come as Chancellor Jeremy Hunt distanced himself from comments made by the chairman of the NatWest bank, Sir Howard Davies, who last week told the BBC that he did not believe it was “that difficult” to get on the housing ladder.

Speaking to financial journalist Martin Lewis on ITV on Tuesday, Mr Hunt said: “I don’t understand how he could have said that. I think people are finding it very difficult at the moment.”